For years I’ve been advising my clients to avoid the Big Banks and credit unions like a fly in your guacamole.

For years I’ve been advising my clients to avoid the Big Banks and credit unions like a fly in your guacamole.

Don’t get me wrong. I’ll do my banking any day at a credit union over some national bank. In fact, I did move all of my banking from some Big Bank™ to a local credit union. As you can learn from Local First Arizona, the more we support locally owned businesses, the more we help our economy. Further, the big national banks don’t deserve our business, after tossing our economy off a cliff like a sad rag doll.

But, when it comes to loans, I can only go on my experience. And I have found that you will always do better with a mortgage broker than a Big Bank. If I really, really had to rank them, I’d go with a local credit union before any national bank. At least with a local credit union, you can elevate a problem to somebody higher up than some sad bank worker in a broom closet.

Still, from time to time our clients insist on using their Big Bank, even after our warnings. So, I want to take this time to express to all five of you who read this blog some of the intractable problems with the Big Banks.

First, a myth. Just because you bank with a company, does not mean you will get the best terms. If you take the deal offered to you by a Big Bank to a mortgage broker, you will probably find out that you will get a better deal. And, if you don’t get a better deal at first, it is only because the Big Bank has not yet had an opportunity to change the terms just in time for close due to some unforeseen circumstance. (Yes, this has happened enough times for me to feel comfortable leveling this charge.)

Second, another myth. Some folks think that if they go with their Big Bank, the bank will hold that loan and not sell it. Thus, you will get to keep all of your business in one place. While many Big Banks will continue to house their loans, there is a very good chance that your loan will be sold off.

Yes, mortgage brokers will sell off your loan. While that is annoying, it is not the end of the world. Its not like the Big Banks are really that good at customer service, anyway.

Problem #1: Bank employees are not typically as qualified as mortgage brokers, in my experience. When we have found a person at a Big Bank who is really smart and committed, we usually see what their own bank bureaucracy puts them through and we certain that they are probably quietly filling out a resume to leave this job to work for a mortgage broker. Many employees are not given a monetary incentive to do a better job. They work for salary, not a good commission.

Problem #2: The really big banks often split the loan and transaction process up in to little bits on a conveyor belt, so that one poor person is just dealing with one part all day, over and over again. They don’t have pull with the underwriters to solve problems and they can’t even see the entire process from where they sit.

Problem #3: Bureaucracy. These banks are so big that you have to spend ages on a phone tree and sometimes you don’t talk to the same person who actually knows you. This is true both during the home-buying process and afterwards.

Problem #4: Attitude. I will illustrate this with a couple recent stories next week. But, by and large, the attitude of the Big Banks is that you and I need them. They don’t need us. Can you blame them? This is the message that they got loud and clear when we bent over backwards to keep them from splitting apart (as they should have done) during the Great Recession.

For now, I need to take a deep breath and do some yoga. If you want to see the second installment of this tirade, have a look here.**

**NOTE: My friend Jeannie Bolger from Nova Home Loans added the following to clarify that loan officers with banks and credit unions don’t have to be licensed to help you with you loan.

“Bank and Credit Union LO’s are not required to be licensed – they are registered, but not Licensed. They did not have to pass a State and Federal test to get the ability to originate a loan. Nor are they required to take licensing hours each year like your and me to stay up to date on the guidelines and once again pass a test to show you are competent to continue to originate a loan.

The banks and CU’s lobbied to be “Waived” from having their employees licensed mainly due to the fact they have the call centers and none of those people could have passed the Federal and State test. It’s expensive and the banks did not want to take on that expense and because they are so powerful they won!!!

So basically, I’m held to a higher standard because I am licensed and I have no problem with that. Just know when you go to a Bank or Credit Union the Loan officer your speaking to is not necessarily Licensed and did not have to pass an Arizona or a National test to originate loans. They could have been a shoe salesman at Macy’s 2 weeks prior. Buyer be aware!!!!”

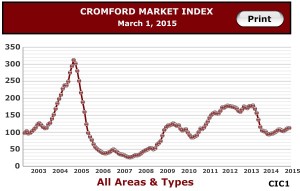

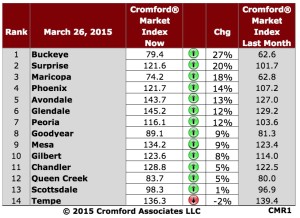

The following is an excerpt from the Cromford Report’s comments from March 30th on the state of rentals in the Valley.

The following is an excerpt from the Cromford Report’s comments from March 30th on the state of rentals in the Valley.

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

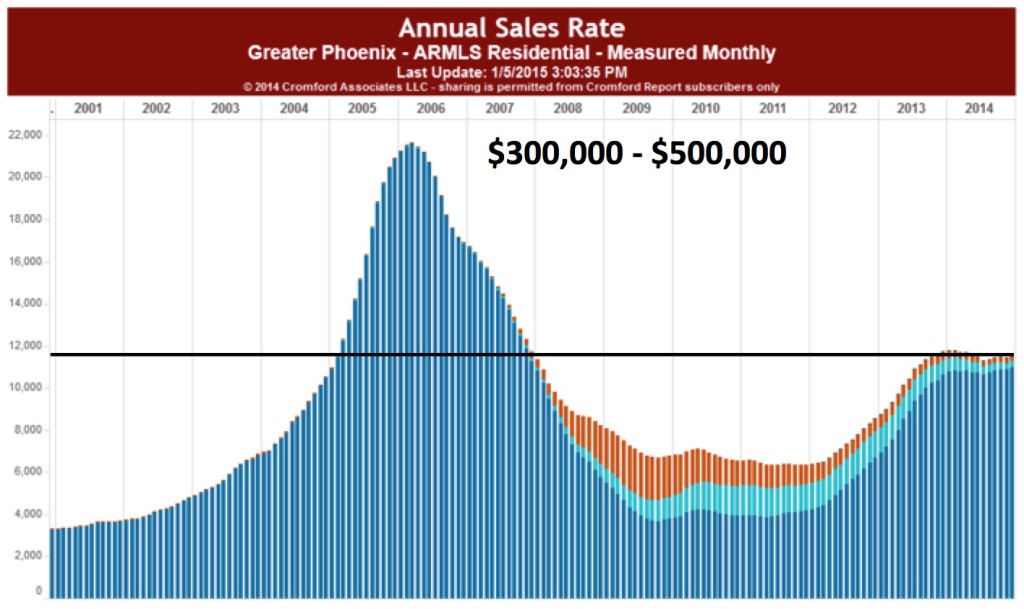

You’ve probably heard me lament about the fact that Generation Y home buyers are not coming in to the housing market as quickly as we had hoped.

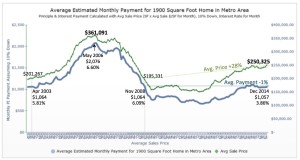

You’ve probably heard me lament about the fact that Generation Y home buyers are not coming in to the housing market as quickly as we had hoped. I don’t want to give you heart palpitations, but if you are planning to purchase a home, you might want to do it sooner this year, rather than later.

I don’t want to give you heart palpitations, but if you are planning to purchase a home, you might want to do it sooner this year, rather than later.

For years I’ve been advising my clients to avoid the Big Banks and credit unions like a fly in your guacamole.

For years I’ve been advising my clients to avoid the Big Banks and credit unions like a fly in your guacamole.