Our friends at the Cromford Report did a little analysis recently of days on market (DOM) over the last 90 days. They showed zip code 85004 with an incredibly low DOM, at 19.

To quote:

Today we look at those zip codes with the lowest Average Cumulative Days on Market for sales of Single Family Residences sold in the last 90 days since June 21st, 2015.

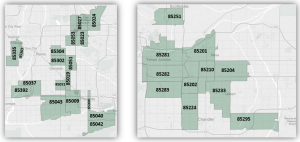

All of the zip codes depicted in the map below had an average CDOM of less than 60 days. The CDOM is the count of days from the time a listing goes active in the MLS to when the status is changed to Pending (not UCB). Many people are placing their listings in UCB status instead of Pending in order to continue marketing them on sites such as Zillow. The UCB status keeps the CDOM counting, while Pending will stop the count. As a result of this behavior, many of our “Fastest Selling” zip codes show a higher CDOM measurement than one might expect. In fact, many of the listings in these areas saw an accepted contract within hours of going active.

Area Zip Code Avg CDOM for SFR sales last 90 days

Central Phoenix 85004 19

South Phoenix 85040 32.9

El Mirage 85335 40.7

West Phoenix 85027 42.1

South Phoenix 85009 45.5

Youngtown 85363 46.6

West Phoenix 85053 47.3

West Phoenix 85019 47.6

Tempe 85282 48.4

West Phoenix 85037 49.1

West Phoenix 85031 49.4

Mesa 85210 49.4

Glendale 85304 50.7

Mesa 85202 52.1

Chandler 85224 53.1

Mesa 85201 53.7

Gilbert 85233 55.1

Avondale 85392 55.2

West Phoenix 85023 55.3

Glendale 85302 56.8

Tempe 85283 57.1

North Phoenix 85024 57.3

South Phoenix 85042 57.5

Mesa 85204 57.5

Gilbert 85295 58.6

Tempe 85281 58.9

West Phoenix 85051 59.2

Scottsdale 85251 59.4

South Phoenix 85043 59.5

But, that 85004 zip code really seems like an outlier for some reason. If you look at the zip codes that primarily house the historic neighborhoods in CenPho, the picture looks more like this:

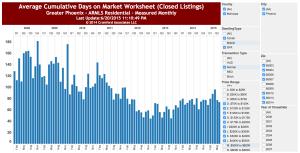

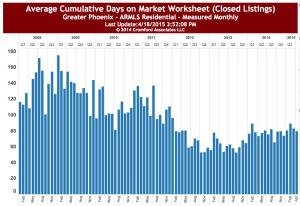

While the number jumped in March, they are generally dropping and hovering around 80 days. Part of this is because, as Cromford said, the way agents classify UBC vs. Pending changes the count. But also I think it is true that homes even in the popular CenPho and historic areas are on the market for this long. Sometimes the sellers list too high, thinking they will get more than they can. Sometimes people over-value a home that needs renovation.

While the number jumped in March, they are generally dropping and hovering around 80 days. Part of this is because, as Cromford said, the way agents classify UBC vs. Pending changes the count. But also I think it is true that homes even in the popular CenPho and historic areas are on the market for this long. Sometimes the sellers list too high, thinking they will get more than they can. Sometimes people over-value a home that needs renovation.

Regardless, if inventories don’t increase, we can expect average days on market to decrease in CenPho.

If you need help building a strategy for your purchase, please give me a call at 602-456-9388. We specialize in this area and we can help you make the right move.

This post follows on a post that I did back in March, in which I discussed that there is such a tight rental market right now. Surprisingly enough, it was called “

This post follows on a post that I did back in March, in which I discussed that there is such a tight rental market right now. Surprisingly enough, it was called “

Our friends at the

Our friends at the

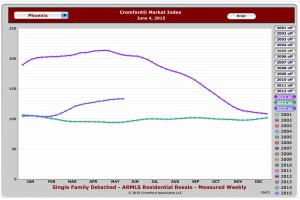

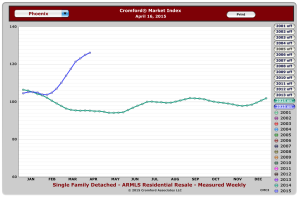

Index was showing that the market was turning toward a sellers’ advantage. I was shocked to see that trend taking an extreme swing upward.

Index was showing that the market was turning toward a sellers’ advantage. I was shocked to see that trend taking an extreme swing upward.