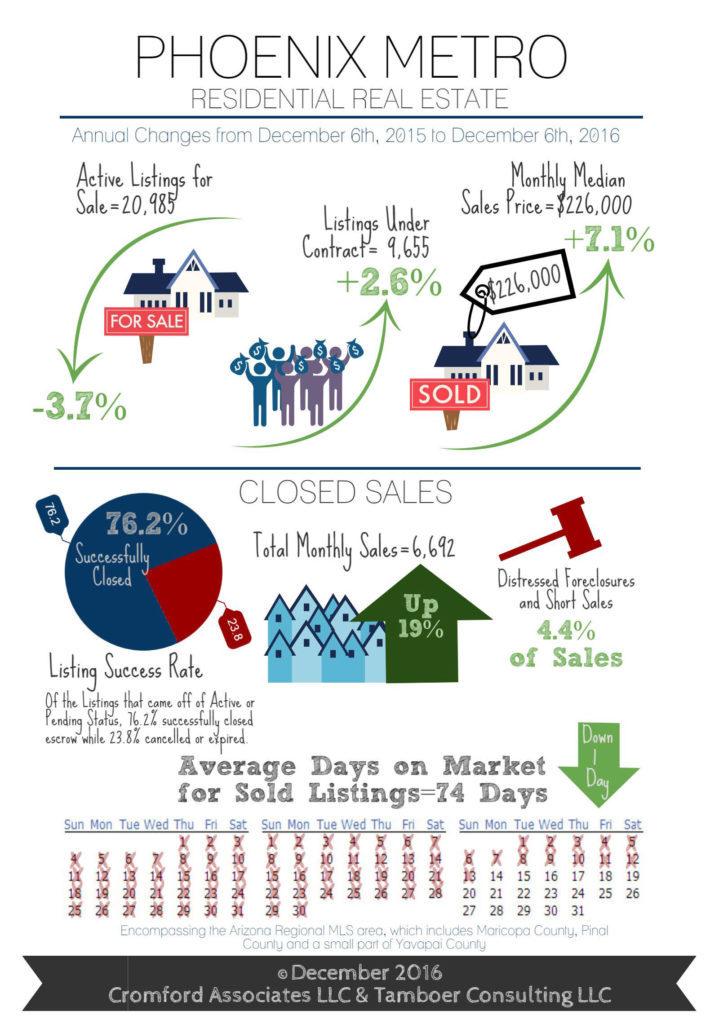

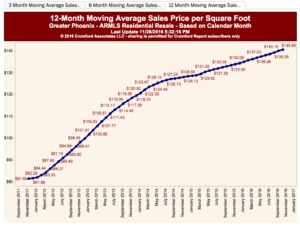

For your June 2017 Market Update, we check in again with the Cromford Report who tell us, in short, that the market is chugging along at about the same upward climb that we’ve been experiencing thus far this year.

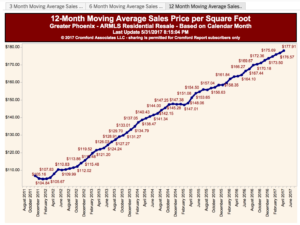

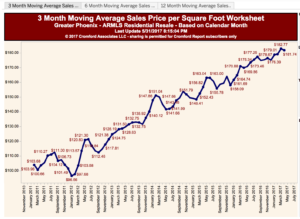

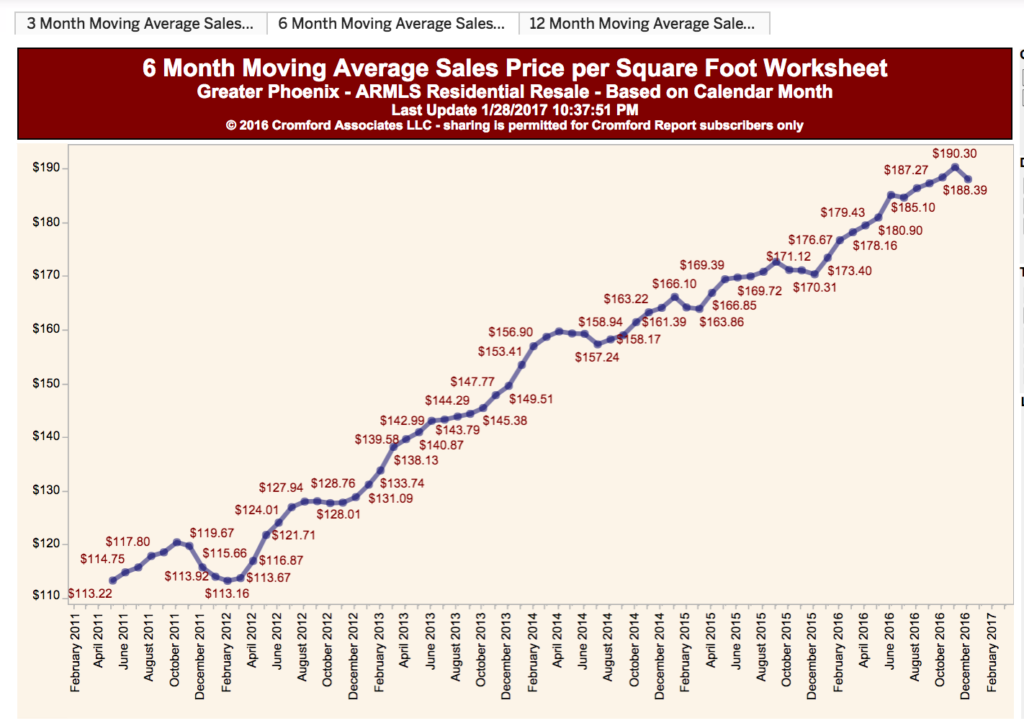

“For the monthly period ending May 15, we are currently recording a sales $/SF of $150.42 averaged for all areas and types across the ARMLS database. This is up 0.1% from the $150.25 we now measure for April 15. We were correct in forecasting last month that the average $/SF would rise less quickly, but after an extremely strong rise between March and April we saw a very small increase over the past month.

On May 15 the pending listings for all areas & types shows an average list $/SF of $153.97, up 1.3% from the reading for April 15. So although last month’s rise was pretty small, we are still expecting a respectable increase in prices over the next 31 days.

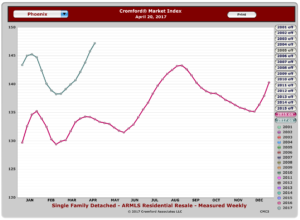

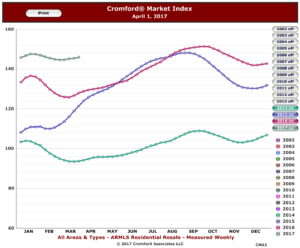

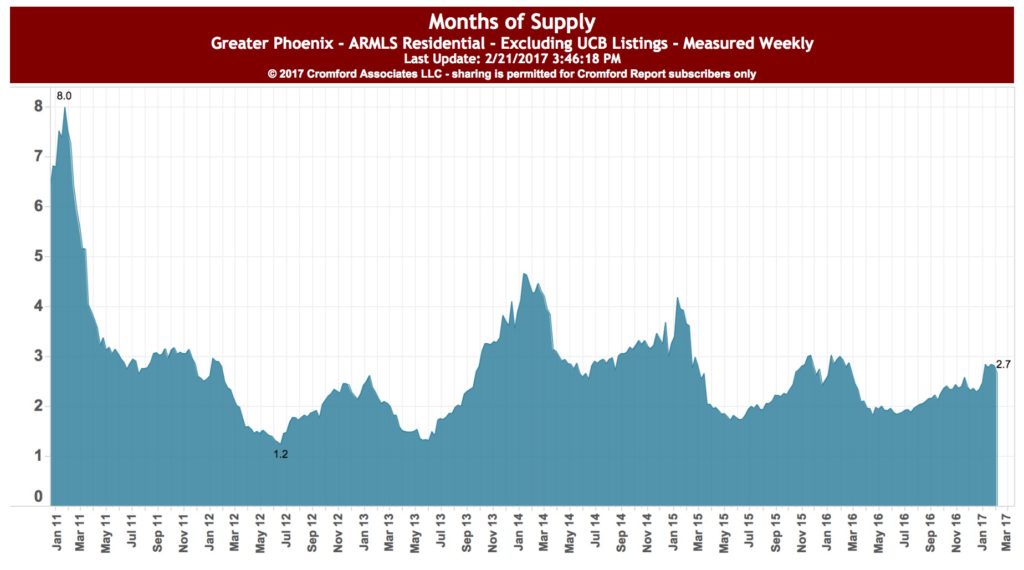

Beyond those 31 days we would expect to see 3 months of price weakness as the third quarter sales mix tends to include fewer high end homes than the rest of the year. However there is no sign of supply and demand converging and the overall long term trend is still upwards.”

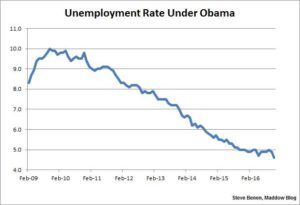

I was on the phone with Tina Tamboer at the Cromford Report this week, speaking about our predictions for 2018 for the June 2017 Market Update. As you recall, I was concerned earlier this year that emigration patterns could have a impact on the market. But, as Tina points out, if people begin to leave Arizona, they won’t do it overnight. It is still too early to tell whether there could be some affect on the market.

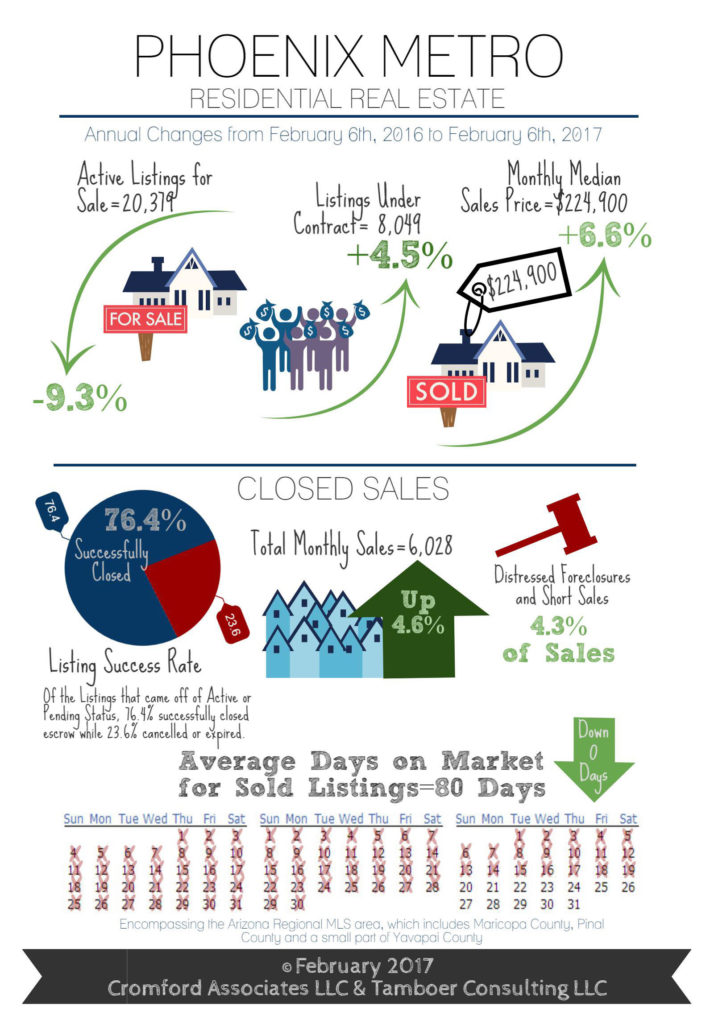

We continue to hear rumblings of a market correction in 2018. But, most of what I hear is a “flattening” of about 3%. Well, we’ve seen that growth in the last year, so we are not talking about the type of correction that is likely to result in major losses for home owners who purchased some years ago.

It might mean, however, that if you are waiting for home prices to reach 2007 peak levels in 2018, you might have to wait a few more years.

In the Central Phoenix and historic districts, both the 3-month and 12-month moving averages for price per square foot are strong. People want to live downtown. So, if you are looking to purchase, it is still a good time to do it. If there is a 3% correction in 2018, that won’t even account for the price difference between December of 2016 and today. But, if there is no price correction, then you are looking at even more expensive homes in this land-locked area with no new construction for owner-occupiers. (Thanks, over-built apartment market.)

If you need to put together a strategy to purchase, give us a call at 602-456-9388.