We are watching a hot market for the April 2018 Market Update.

First, here’s the perspective of the numbers crunchers over at the Cromford Report:

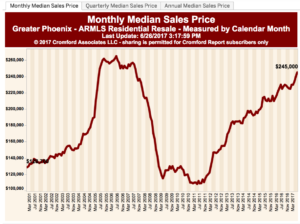

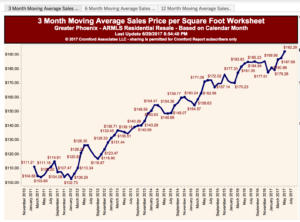

For the monthly period ending March 15, we are currently recording a sales $/SF of $159.67 averaged for all areas and types across the ARMLS database. This is up 0.3% or $0.55 from the $159.12 we now measure for February 15. On March 15 the pending listings for all areas & types shows an average list $/SF of $166.06, up 1.5% from the reading for February 15.

Translation: the market update shows that county-wide averages for prices continue to inch upward, but not at a dramatic pace.

The CenPho and historic markets, more narrowly defined, are active, but not what Cromford would consider “hot”, especially at the higher price points.

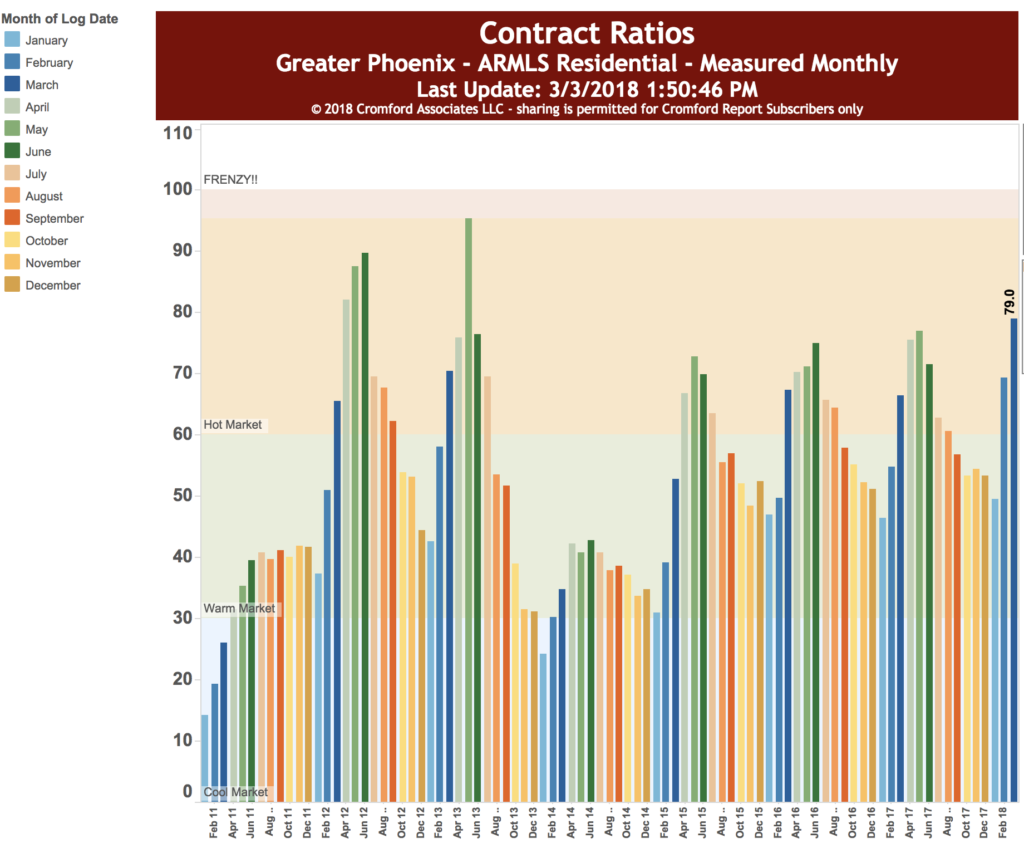

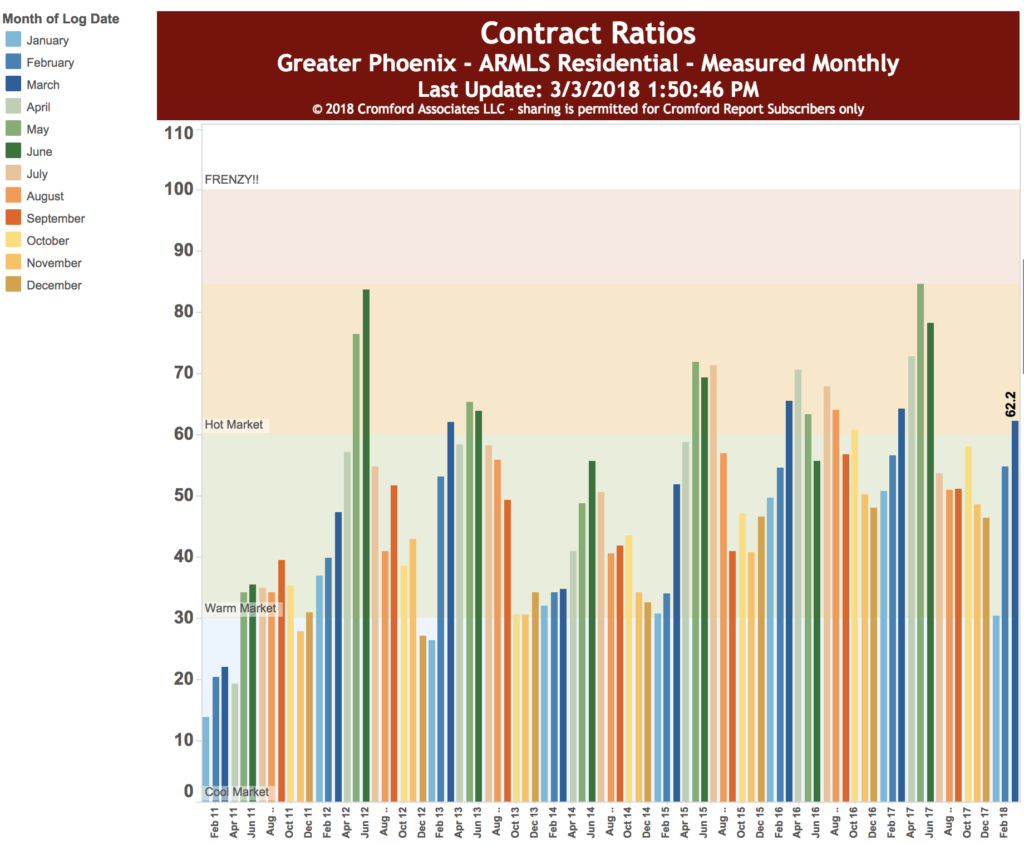

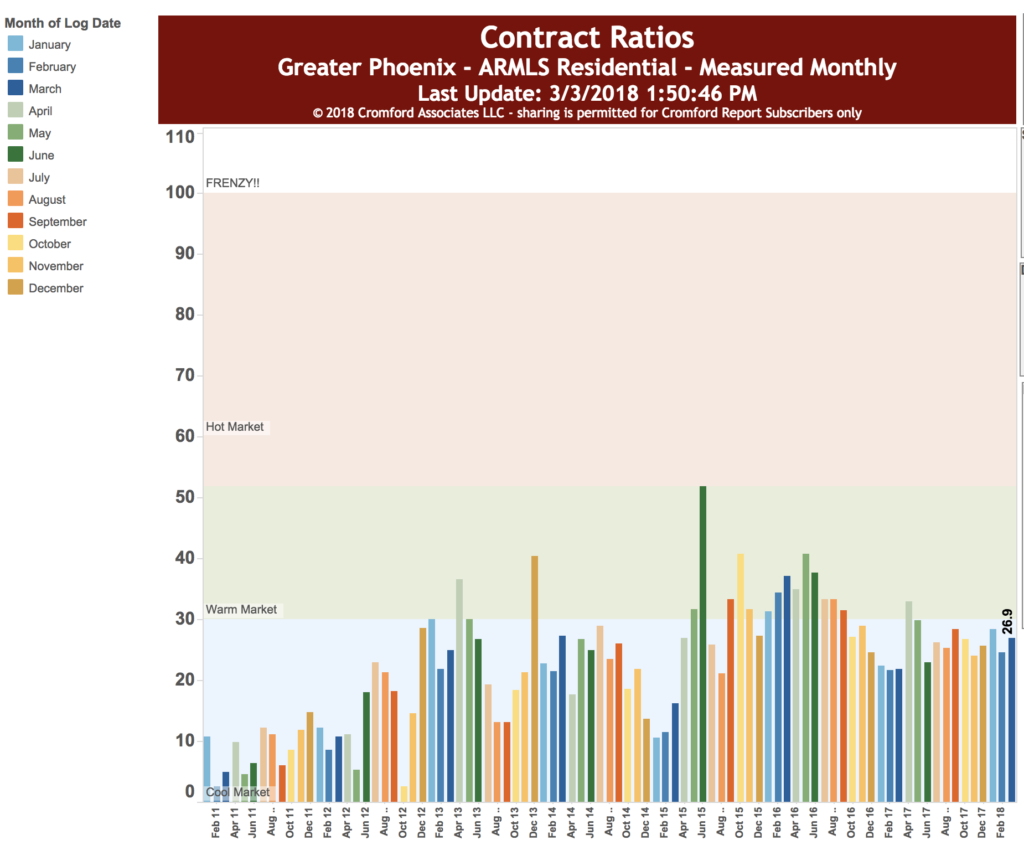

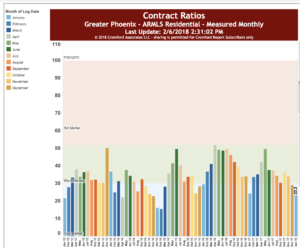

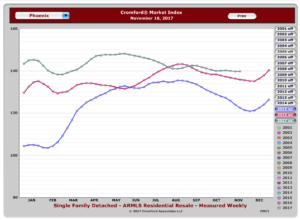

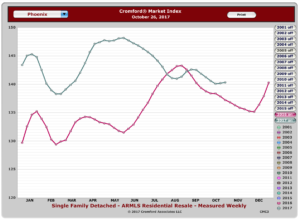

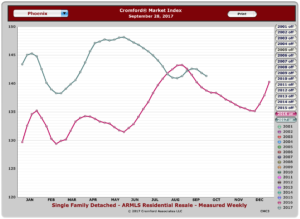

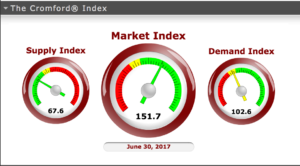

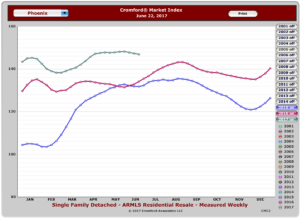

Look at these three charts measuring the “contract ratio”. Remember, the contract ratio measures the number of completed sales contracts relative to the supply of active listings.

1. Valley-wide contract ratio for single family residences, all prices. Notice that we are in the “hot market” band of the chart.

2. If we just look at Cenpho and historic neighborhoods, we go from hot to warm. Why is this, given that no new homes are being built in this area? Shouldn’t it be hot? It may be that people have been listing a little too high for the market, and their listings are staying on longer, or are dropping off. This is true, wether we are looking at all homes (52.6%) or just homes below $500,000 (62.2%)

3. If we look at Cenpho, historic, same area and above $500,000, we see that the Contract Ratio drops to about ____. It is normal for more expensive homes to take longer to sell and for more of them to drop out of the market. So, this is not alarming.

What it does seem to show is that the historic markets, while active, are not as hot as the over-all county. It is hard to say why –and perhaps the wonderful nerds at the Cromford Report would disagree– but I believe it may be that sellers might have priced too high at first in the historic neighborhoods. Combined with possible uncertainty on the part of buyers about whether they should buy now or wait for a market shift.

While I’ve been expecting a market shift for some time, I’m starting to believe that it may not come as soon a I originally thought. This is probably due to two things. First, there are no new houses to speak of in CenPho. Second, with a high stock market, people are still looking to real estate as a place to park their money.

We are watching the market closely. If you are thinking of buying or selling, use a team that knows the numbers. Call us at 602-456-9388.