Just because I’m a Realtor®, does not mean that I am willing to go along with everything the State or National Associations of Realtors says.

Just because I’m a Realtor®, does not mean that I am willing to go along with everything the State or National Associations of Realtors says.

Typically, in Arizona, they have attempted to undermine rights residential users of solar energy. Nationally, they don’t typically support environmental laws that I support.

But I am ready to step out and say that we should not extend the $8,000 tax credit past the November 30th deadline. This is sacrilegious to some. Aren’t I undermining my own business? Aren’t I preventing people from buying houses?

Well, my personal business is not as important as the fate of the country. The program has cost the country $15 billion. The National Association of Realtors wants to increase the credit to $15,000 and remove the first time home buyer restriction. It will cost the general fund between $50 and $100 billion. And, over time, we will find all kinds of loopholes, so that will only grow.

We are looking at a bankruptcy of Medicare and Social Security on the horizon, and we are supposed to expand this program? Unacceptable.

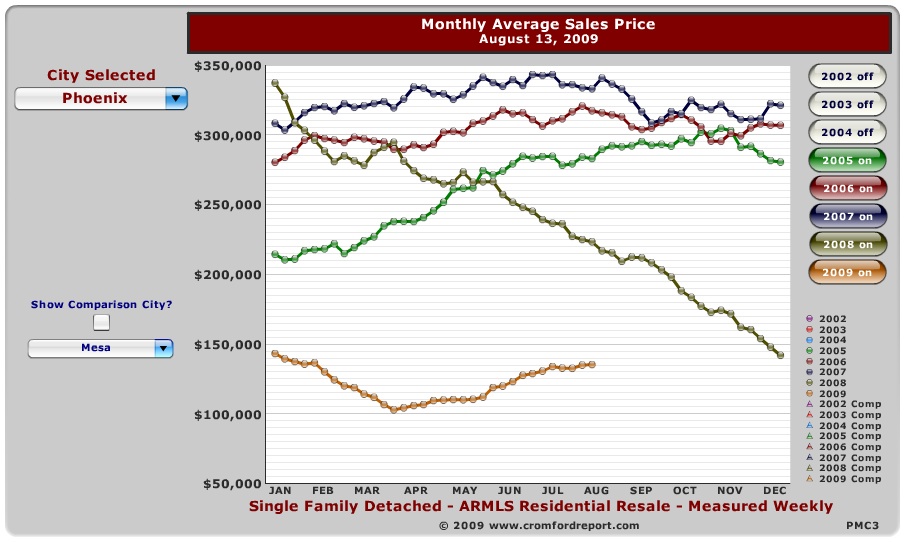

As for preventing people from buying houses, I simply don’t accept that the market will dry up. We have record low home prices in America. The market will do better as the rest of the economy recovers. Further, banks still have many, many foreclosed homes that they have not released into the market (over 40,000 in Arizona). While we don’t want them to release them all at once, a steady stream of homes on the market can keep prices down.

For me, it is a simple equation: we needed the boost in the housing market, but it is not worth creating a permanent new hand-out when the result will just add to our staggering deficit and debt.

Now, here is another idea for you to ponder. It might be high time that we eliminate the tax deduction on the interest on your home. Or, at least we need to replace it with something that is more geared toward new home ownership. Now, that is sacrilege! I’m trying to find the article in my stack of old magazines. It was either in the Atlantic Monthly or the Economist, but this is not a new argument.

It goes like this: the interest deduction encourages people to buy houses that are  unrealistically large for their income, it encourages sprawl, it is a huge drain on our general fund when we can’t afford it and it is used by people for second homes. Heck, my parents take an interest deduction on their stinkin’ RV because it is a second home!

unrealistically large for their income, it encourages sprawl, it is a huge drain on our general fund when we can’t afford it and it is used by people for second homes. Heck, my parents take an interest deduction on their stinkin’ RV because it is a second home!

Really? You gotta squint really hard and look sideways to call an RV a second home.

Regardless, if the goal is to get first time home buyers in to a home so that they can become stable, why give a credit for a second home? Why not offer a one-time $15,000 tax credit for your first home. After that, you are on your own.

I’ll find that article and link to it. This it a very touchy topic, so I’d love to see some debate on it.

As for this topic, check out a very good article on the issue, here.

A legislator (

A legislator (

But, here are two stories that illustrate how recovery happens: when prices get so low that investors and consumers can’t help but get back in the market.

But, here are two stories that illustrate how recovery happens: when prices get so low that investors and consumers can’t help but get back in the market.

Well, the bill has caused quite a few problems. Most importantly, it will encourage more foreclosures and bankruptcies. Here is why: Arizona has a relatively short foreclosure period (90 days). If banks know that all they have to do is wait out an owner in order to foreclose and still be able to go after the deficiency, then they are more likely to do that. This will impact more than just people who are flipping homes. This could impact all kinds of buyers, not just “flippers.”

Well, the bill has caused quite a few problems. Most importantly, it will encourage more foreclosures and bankruptcies. Here is why: Arizona has a relatively short foreclosure period (90 days). If banks know that all they have to do is wait out an owner in order to foreclose and still be able to go after the deficiency, then they are more likely to do that. This will impact more than just people who are flipping homes. This could impact all kinds of buyers, not just “flippers.”