OK. So, maybe “Love” is a little strong.

However, if you know me, you know that I’ve been advising against buying a short sale home. You also know that I’ve been advising against trying to sell short.

For the buyer, my biggest concern has been that you would wait for months before you hear back from the bank.

For the seller, my biggest concern has been that you are led to believe that your house will sell quickly because your agent under-prices it, then it does not sell in time because buyers don’t trust the process and then you foreclose anyway.

Well, there are some trends that are indicating that things are getting better.

Don’t get me wrong. We should not turn in to a society of short sellers. That is really bad for the market and really bad for home ownership.

However, if you are getting distressed and you are really, really stuck, this might be of interest to you.

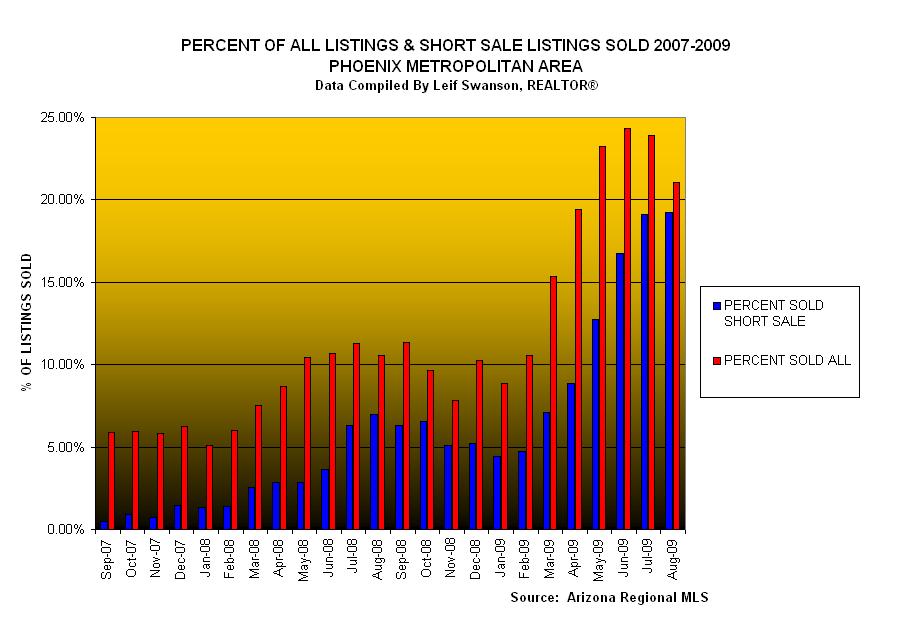

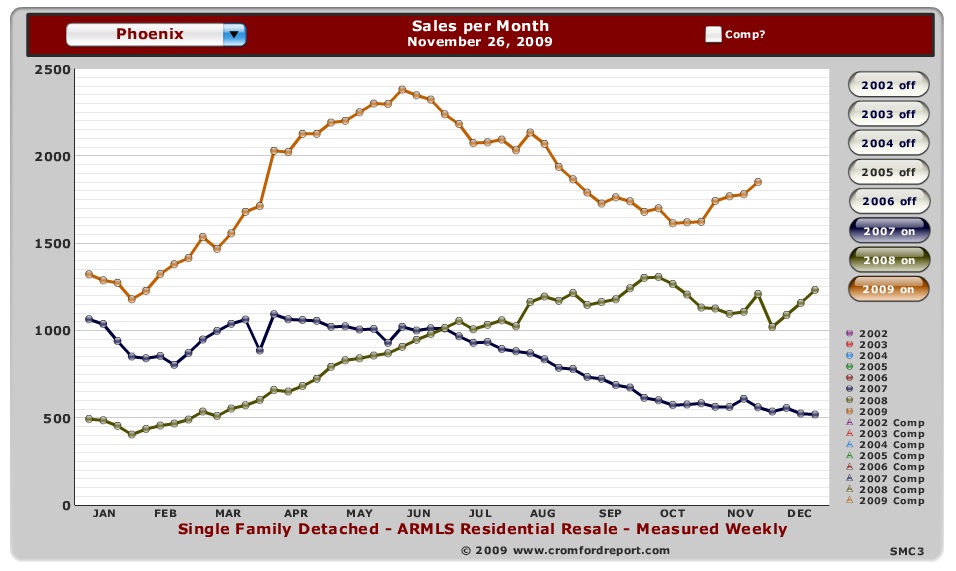

First, the number of short sales that are selling has increased. If you look at the chart, below, you will notice that the percentage of short sale homes that have sold has increased, as a portion of all of the homes that sell. These are the latest numbers.

The blue lines represent the short sales and the red line represents all of the sales, total. For you who are tracking the numbers, that equals to about 7,700 sold homes, total and 1,400 of those that were short sales. Compare that to about 4,000 total sales in Sept. 07 with only 20 short sales completed.

In other words, your chances of getting a short sale through the process before it goes to foreclosure is now up by 700% since Sept. 07. Or, by 200% since May of this year.

Second, short sales represent about 48% of the market now. So, it is more difficult to get away from them. My colleague, Leif Swanson and I have been working more on the short sale issue and are confident that we have ways to get through the process in a reasonable time. We are also interfacing with teams of people who are very good at it. If you are thinking that you might have to short sell, please give me a call at 602-456-9388.

Third, your chances of getting a home that has been terribly damaged by vacating owners is greater with a foreclosure. I don’t have any numbers on this. But a short sale requires that the vacating owner work with everybody to sell the property. Sure, they may be upset, but they are not as likely to trash the kitchen on the way out.

In the end, it is not ideal. Far from it. We just have to hope that all of the foreclosures and short sales clear the market over the next year and we can get back to a “normal” market.

But, in the meantime, we may just have to learn to love the short sale.

Notice also that there is a greater trend toward short sales over foreclosures. The percent of foreclosures continues to drop both as Closed transactions (44%) and in the Pending category (35%). 25% of the active listings were short sales. 31% of the pending sales were short sales.

Notice also that there is a greater trend toward short sales over foreclosures. The percent of foreclosures continues to drop both as Closed transactions (44%) and in the Pending category (35%). 25% of the active listings were short sales. 31% of the pending sales were short sales. If you are FHA-financed and get an offer accepted by the end of next week, you

If you are FHA-financed and get an offer accepted by the end of next week, you