Ever heard of a seller carry-back? Quite possibly not. The house pictured here is offered as a seller carry-back.

Ever heard of a seller carry-back? Quite possibly not. The house pictured here is offered as a seller carry-back.

The best way to describe it is when the seller of a property “carries the loan” instead of a bank.

So, imagine you are the buyer of a home. Instead of going to a bank to get money to give to the seller, you just pay the seller in installments. The seller and you figure out what your interest rate will be and how long he or she will carry the loan. Let’s say 10 years at 6% interest, amortized over 30 years.

Huh?

Let’s look at that again. You calculate the loan based on a 30-year term. You pay monthly installments as if it is a 30-year term, but the balance of the loan will come due at the end of 10 years.

So, let’s say you buy a $200,000 house with a seller carry-back, and you put down 10%. You amortize at 30 years and the seller charges you 6% interest. Your monthly payments will be about $1,100.

At the end of about 10 years the balance will be somewhat more than $100,000. At that point, you either come up with cash or you get a loan from a bank.

The entire time, a title company takes a small fee and keeps track of the payments for you. So, it is safe for the buyer.

If you can’t buy the house at the end of the 10 years, the house goes back to the owner. So, it is safe for the seller.

Who uses this?

1) People who can’t get a loan. In the early 1980’s the average bank loan interest was somewhere around 15%. So many people did seller  carry-backs and left the bank out of the equation all together. They made a private deal between the buyer and seller.

carry-backs and left the bank out of the equation all together. They made a private deal between the buyer and seller.

2) Co-op owners. A co-operative is kinda like a condominium, but you can’t get a loan on a unit in a co-op. Long story. So, it is either cash or seller carry-back only.

3) Family members. Sometimes families or trusts will do seller carry-backs so that they can sell something without the bank involved. That way the profit from the interest payments stays in the family.

4) Investors. I have met investors recently who buy homes, then do a seller carry-back with somebody, knowing that that person could get a loan later, but now now. This gives the investor a stream of income on their property.

5) Sellers who don’t want to sell in this market. If the market average is $140,000, you, the seller paid off your home a long time ago and you don’t want to sell at that price, you can sell at a higher price to a person privately. The price is higher than you can get right now, but lower than the buyer could probably get 10 years from now.

Why is this relevant?

I’m in awe that we are not doing more seller carry-backs. Hundreds of thousands of people who have lost houses due to foreclosure or short sale have bad credit but are not necessarily a risk to the seller. If you can’t deal with the bank deal with a human being!

I think the only reason we don’t see more is because so few people know about this tactic. It was 30 years ago that they were last seen commonly.

Could you imagine what the housing market would look like if we could get more buyers buying up some of the lost and forlorn homes? Many buyers can’t get it from a bank. But if an investor buys a home from the bank and a buyer can buy it from the investor on reasonable terms, why not? If you write a contract and have a title company manage the payments, then you are safer. (Never do a seller carry-back on a handshake!)

How do you find them?

The Multi-listing Service has a tag for homes where the seller is willing to do a seller carry-back. All I need to do is look for you. Please shoot me an email at realestate@kenclarkforaz.com and I’ll have a look.

In an era when we all feel pretty stung by the banks, I am surprised that we are not doing more of these. Maybe this is a great way to vote with our wallets and tell the banks what we think of them!

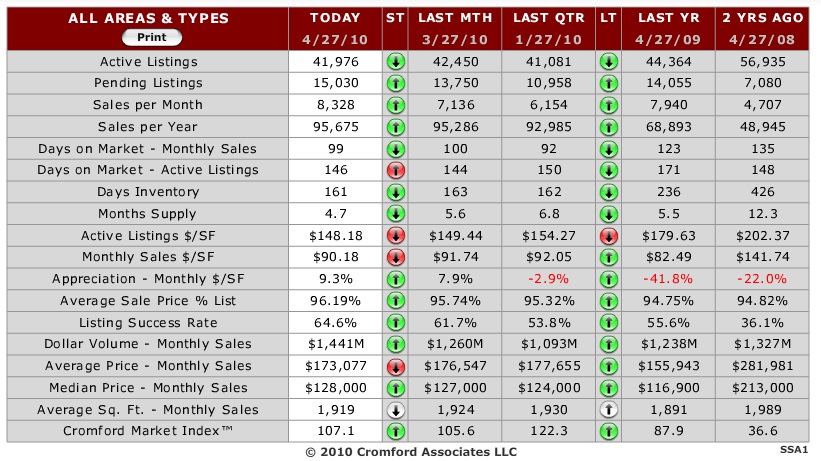

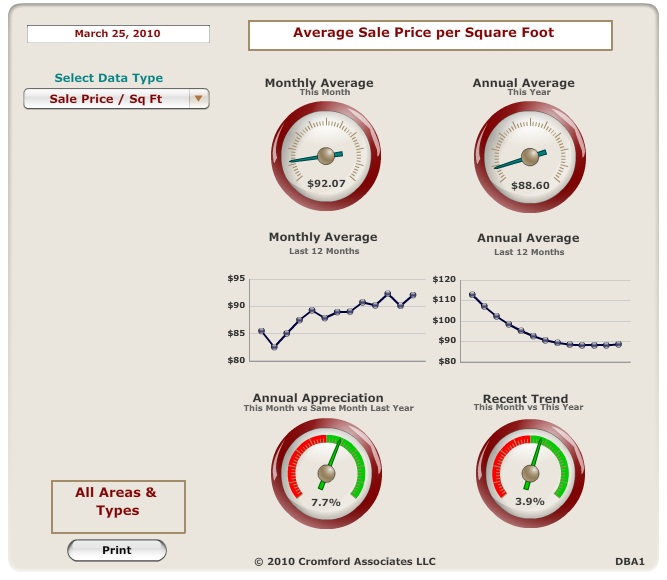

As you might guess, March was an insane month.

As you might guess, March was an insane month.

This

This  This news just in from John Hall and Associates:

This news just in from John Hall and Associates: Really. It’s going away. The $8,000 first time home buyer and the $6,500 repeat home tax credits will not longer be available after the end of April. So, set your clocks!

Really. It’s going away. The $8,000 first time home buyer and the $6,500 repeat home tax credits will not longer be available after the end of April. So, set your clocks!

1)

1)