Here is this week’s updated list of the best deals in the ‘hood.

1) This expertly updated ranch in CenPho (now only $149,500) is walking distance from Light Rail and convenient to all the CenPho attractions. You can walk to Lux, Pane Bianco, Copper Star and all the shopping on 7th. That’s heaven!

You should see the upgrades: triple-pane Pella windows in the living room, a block addition to the master bedroom, with bath and a lush back yard. This 2br/2ba home is a great first home, its roomy and move-in ready.

2) 2-Bedroom, 1.75-Bath Easy Livin’ Condo. You’ve heard me rant about this little 1950s complex. It is shady, inexpensive, picturesque and built as sturdy as a fallout shelter. This 1,100 square foot place came on the market last week at $41,500. I’ve not seen many people look at it. It does not help that the carpet needs to be ripped out and replaced (what were those people eating?). But I think this price should come down in to the high $30s. I’d rip out the carpet for that price!

3) 1-Bedroom, 1-Bath Starter Condo. OK, there is a theme here, I know. But these places are so inexpensive, it blows my mind. They are listing this one, at 846 square feet, at $31,000. I’m telling you right now, I think this place should go for about $3,000 less. It is HUD-owned, so they have a different bidding process. I can help you with that. But if this is your first property, you can’t beat the price. Your monthly costs would be less than $500, assuming you are paying a loan back to your uncle Albert. (You are not likely to get a home loan for this low, so these are cash deals only.)

Call me at 602-456-9388 for more information.

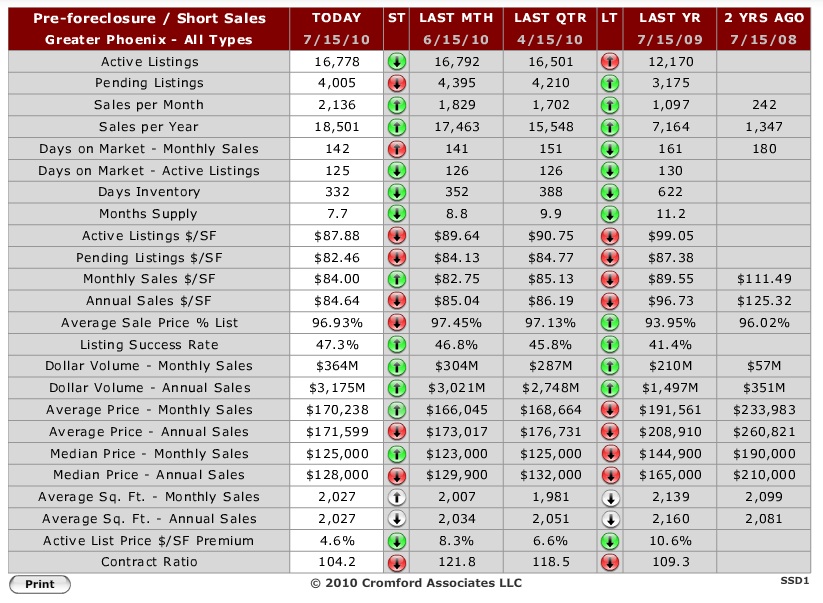

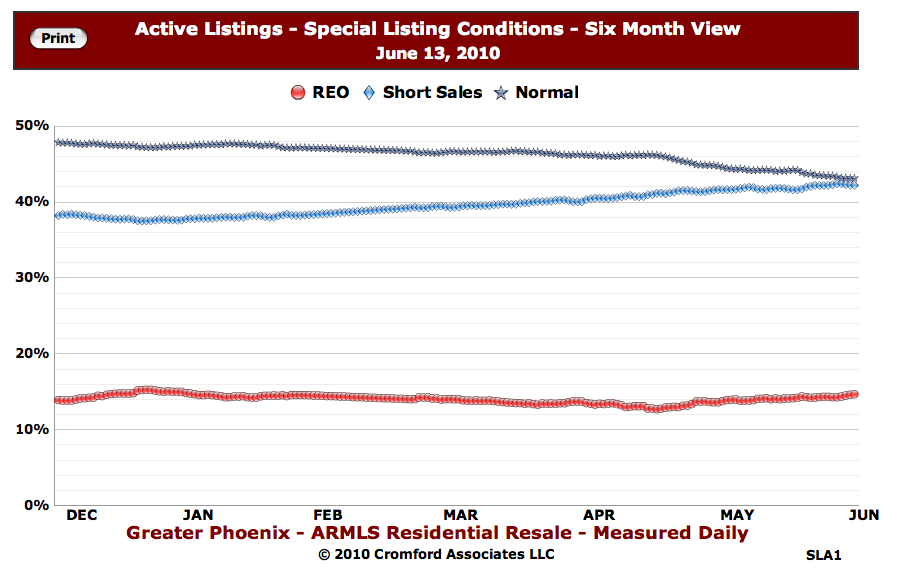

My friend in the real estate industry was commenting to me on Tuesday that it is difficult these days to be taken at our word.

My friend in the real estate industry was commenting to me on Tuesday that it is difficult these days to be taken at our word.