So, when the inventory goes down, what happens? Yep, demand goes up.

I’ve heard all this talk about a double dip recession (which we now know never happened) or this second huge wave of foreclosures (which has also not happened). I’ve learned not to trust the doomsayers in the press or at the universities.

In fact, the market has been clearing the inventory of new foreclosed homes as quickly as they have been coming on.

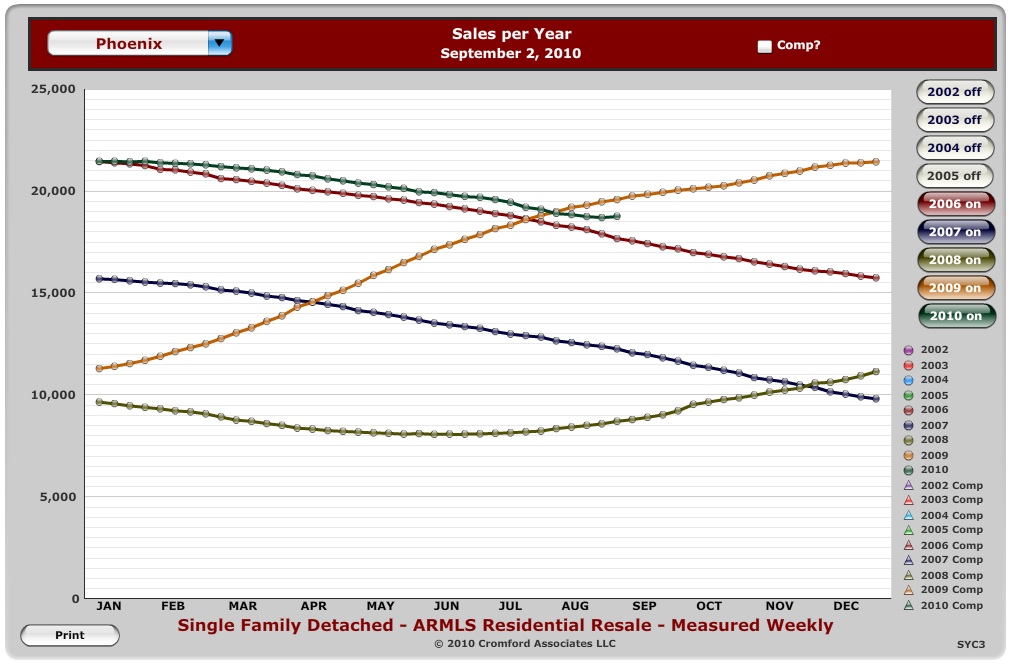

This time last year, we were on track for 24,995 annual home sales in Maricopa County. As of today, we have sold 30,063 in the last 12 month period. (Source: www.cromfordreport.com)

Wave? Right.

So, here is what I’m seeing:

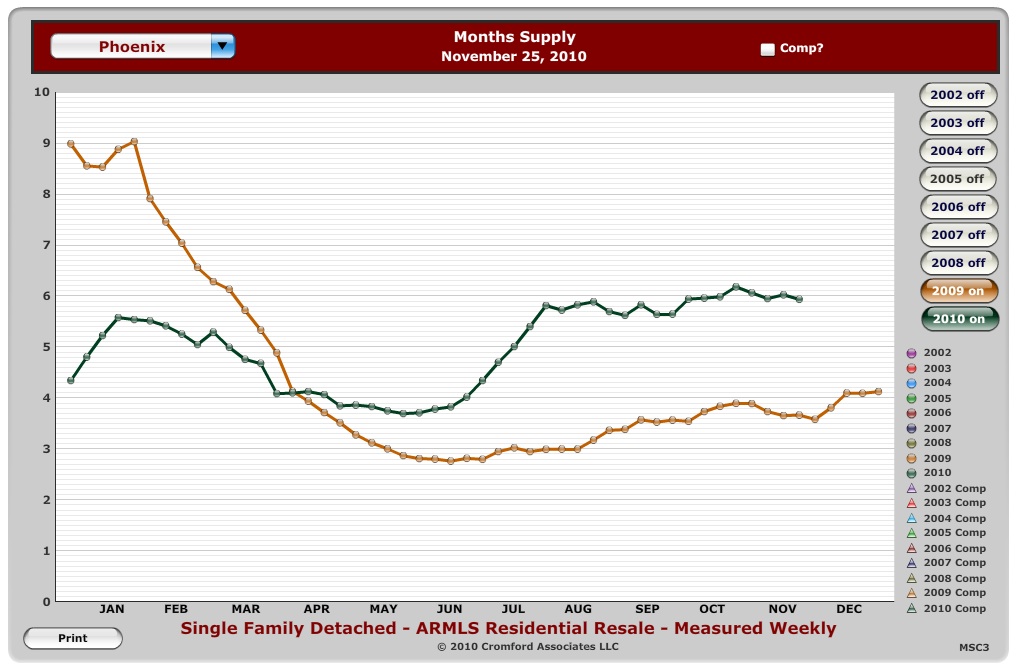

1) Inventory is actually down a little since September. See below. This is an incredible time to pick up a new home.

2) I’m seeing investors snapping up the good homes in less than a week. Those that need more work sit on the market longer. So, if you are looking, be ready with your Loan Status Report or your Proof of Funds so you can jump on a good deal when you see it.

3) Don’t expect prices to drop too much further. They tend to drop around the holidays, but people start scooping up properties in late January.

4) We still don’t know how long these low interest rates will hold out. A slight change in interest rates can mean a huge increase in your monthly payments.

5) If you are thinking of selling, hold off a little longer, unless you have true equity in your home.

Give me a call if you have more questions.

Three major condo projects, 44 Monroe in downtown Phoenix, 3rd Avenue Palms in Phoenix and Safari Drive Scottsdale, all went in to foreclosure in 2007 when the builders could not sell at the obnoxiously high prices they listed.

Three major condo projects, 44 Monroe in downtown Phoenix, 3rd Avenue Palms in Phoenix and Safari Drive Scottsdale, all went in to foreclosure in 2007 when the builders could not sell at the obnoxiously high prices they listed.

I have been inundated over the last week with conflicting market news.

I have been inundated over the last week with conflicting market news. There was this very

There was this very