If you’ve read my blog much you’ve seen that I have a more positive view of where the market is going than, say, the Arizona Republic.

You may be asking, “When is a good time to buy in Phoenix?”

Well, pretty much any time now. Below are some data-based reasons why you should feel comfortable buying a house this year. This information is based on The Cromford Report, which is data aggregated directly from the Multi-Listing Service, the most accurate account of sales in the market.

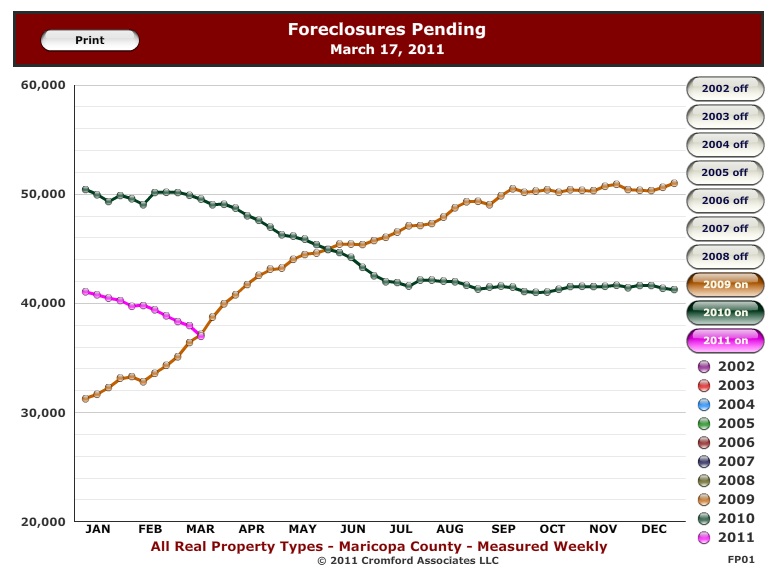

1) Combating the myth: “The Wave of Foreclosures”

A whole army of chicken littles out there like to tell you that there is a “wave of foreclosures” coming down the pipe. This chart should tell you just how wrong that prediction is. You can see how the general trend has been downward since 2009. It is important to note that it is not in the banks’ interest to allow too many foreclosures on the market all at once. That would depress prices and mean fewer golf trips for the bank executives.

2) Pending Foreclosures

“But aren’t there a bunch of people who are likely to foreclose soon?” Well, fewer now than any time since March of 2009, actually. Further, as the economy slowly improves fewer people will foreclose on their homes. See below how the number of pending foreclosures is going down quite dramatically now.

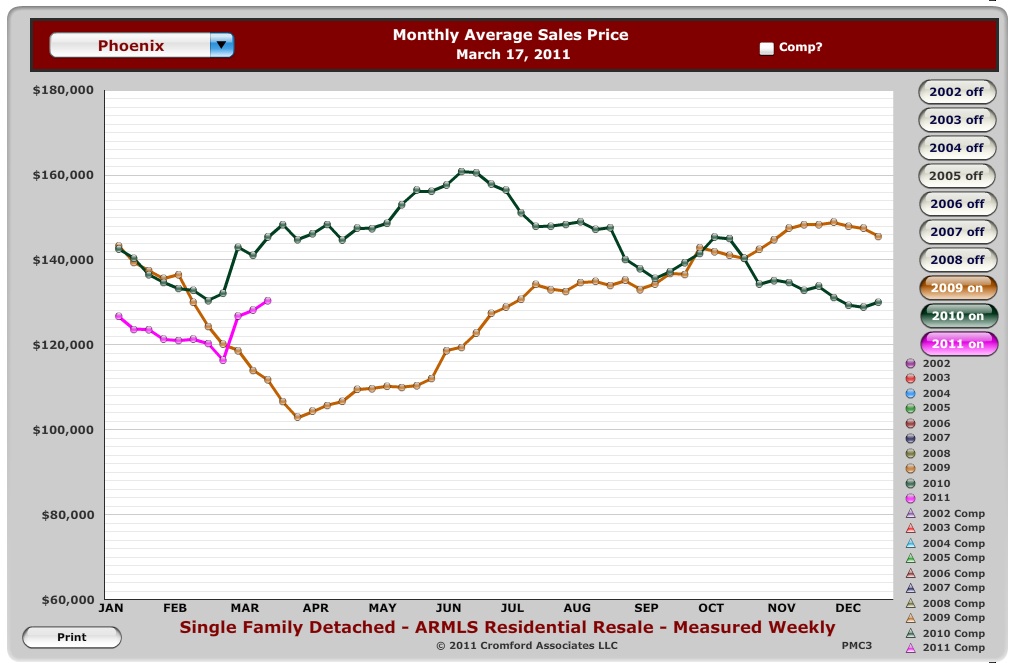

3) Myth #2: “Prices are going to drop again.”

So, knowing what you see above, it makes sense when you see that prices are higher now than the lowest point in the market, back in April of 2009, and are edging toward the 2010 averages. HINT: The high buying season in Phoenix is always the summer. So, watch for prices to keep going up. Further, people are saving an average of 6% of their monthly income (compared to about 1% a few years ago). Once they hear enough good economic news, they are going to start spending that pent-up money on big-ticket items (read: “houses”).

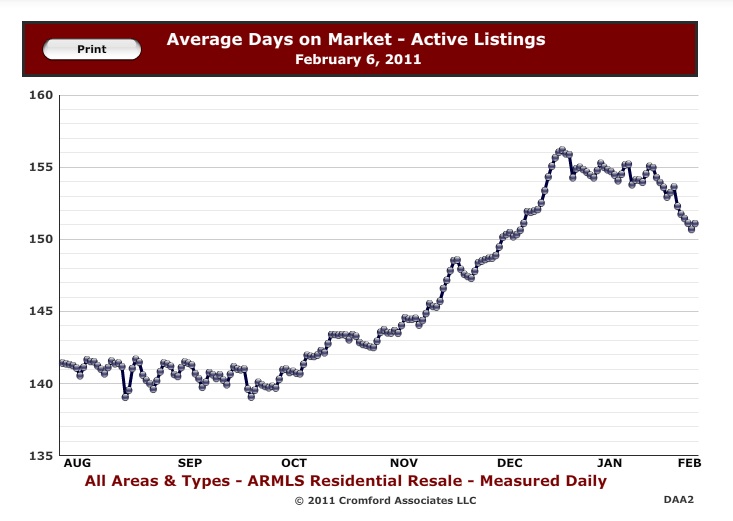

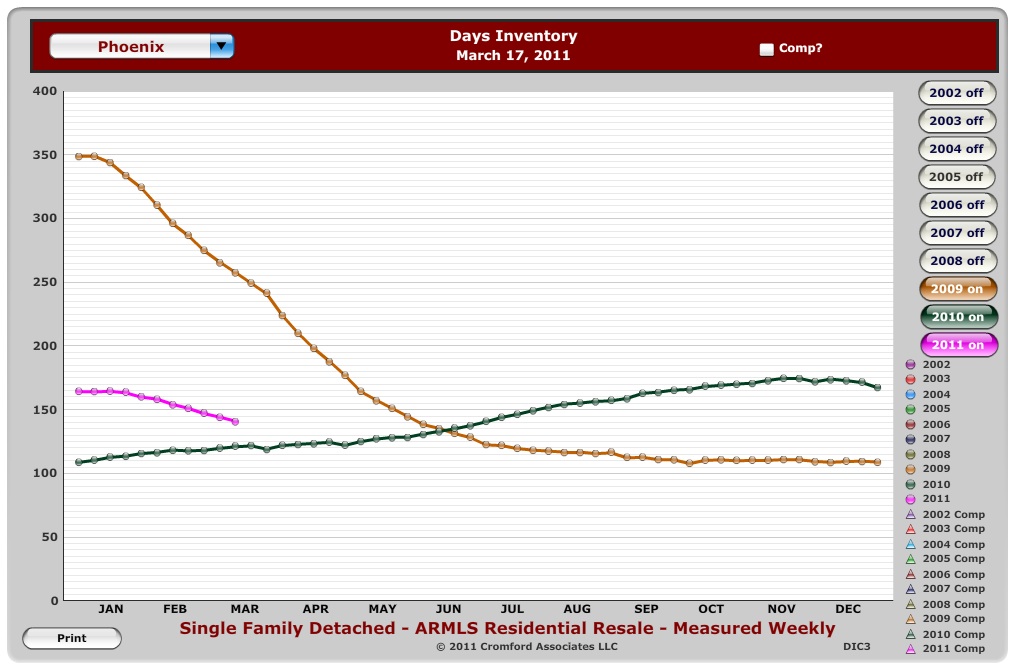

4) Days Inventory

How am I sure prices will go up? Well, when inventory goes down, prices go up. Its Econ 101. Here’s the trend! Inventory is going down! “Days Inventory” means how long would it take to exhaust all of the inventory of houses at the current rate of sales in Phoenix. We are at about 140 days right now.

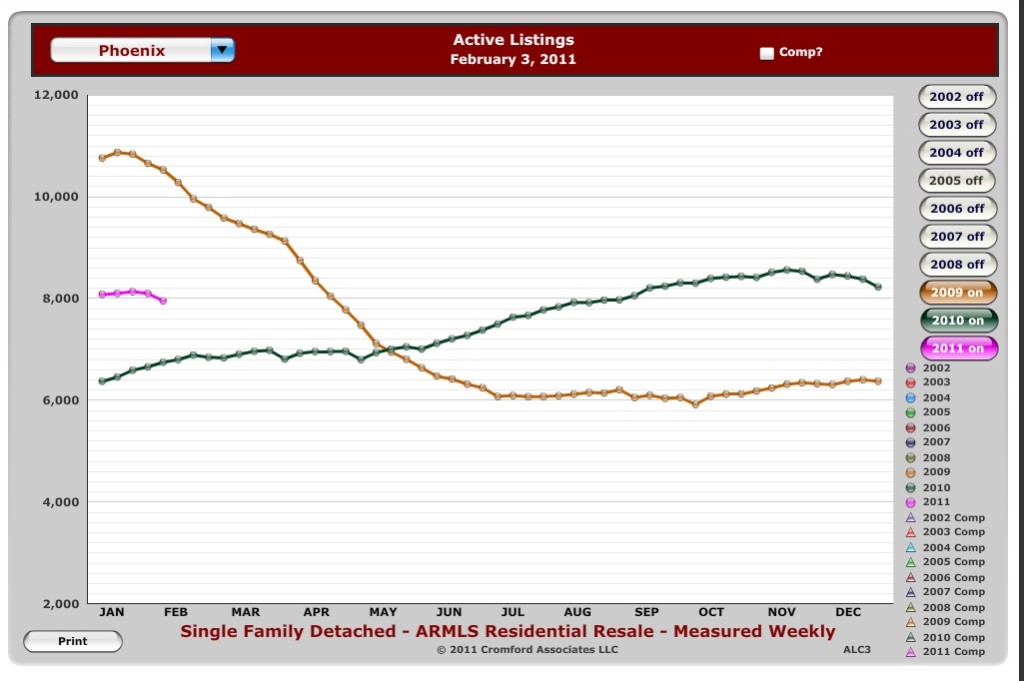

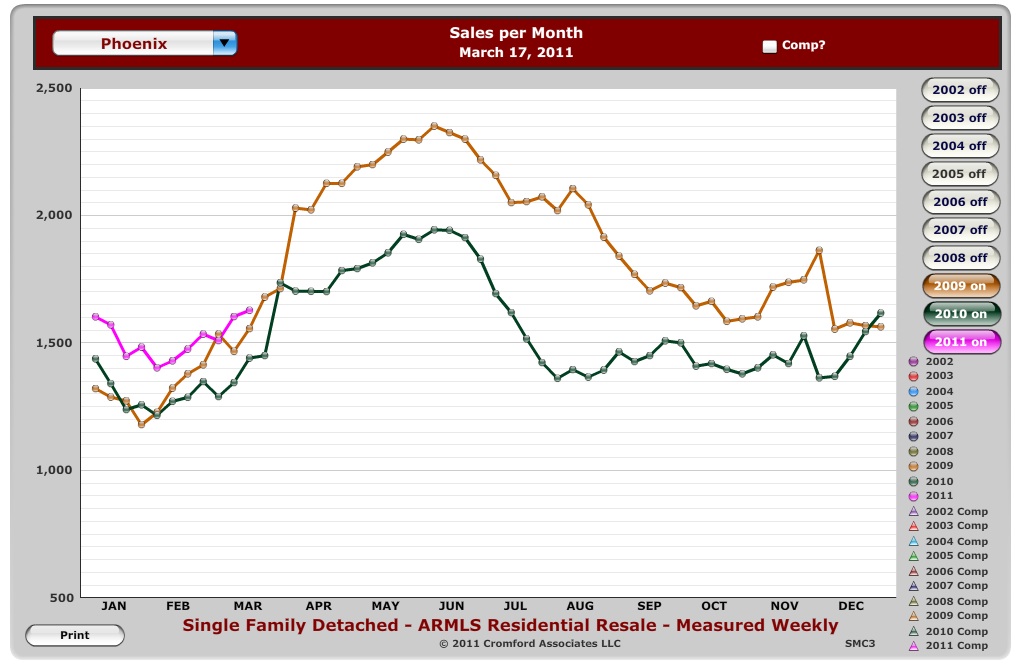

5) Sales per Month

Want another reason? The sales per month are going up. So, when inventory goes down and sales go up what happens? Prices go up. I said it here! It won’t be dramatic, but prices will go up. Interest rates are going up now, too (over a point in the last 2 months). If you want to grab something before both interest rates and prices go up, now is the time to make it happen!

Is is time to buy in Phoenix yet? The answer is “yes”, you can feel safe making that decision. We can watch the market together. Call me at 602-456-9388.

This data comes from my friends at Old Republic Title and Escrow and pertains only to the single family detached market (i.e. not condos, patio homes or townhomes).

This data comes from my friends at Old Republic Title and Escrow and pertains only to the single family detached market (i.e. not condos, patio homes or townhomes).

Last week I

Last week I