My friend in the real estate industry was commenting to me on Tuesday that it is difficult these days to be taken at our word.

My friend in the real estate industry was commenting to me on Tuesday that it is difficult these days to be taken at our word.

He said, “People I talk to expect me to say that now is the best time to buy, so they discount what I’m saying. But, really rates have not been this low in 40 years and houses will probably not be this cheap again in our lifetimes. I’m not trying to sell something that isn’t real, you know.”

It is difficult, especially when you see that rates are taking a quick drop again, despite the fact that we’ve been afraid that interest rates would take a quick jump upward and that would put a damper affordability, especially for first time home buyers.

Have a look at this post from February to learn how a 1% increase in rates can have a major impact on what you can afford.

These things tend to jump up and down, so this is great news. But, they can just as easily pop upward again if the markets think that the government has taken on too much debt. If you are thinking about buying, lock these rates in now.

Here is a shameless cut-and-paste from something that my friend over at Met Life, Dan Hlavac sent me about where rates stand right now.

Please give me a call if you need more information.

—————

Even though the trend so far this year and likelihood through year end is that mortgage rates have been rising, right now mortgage rates are at the lowest they have been all year. Those of your who thought you missed the boat on the best rates have been given a second chance. It is still widely expected that rates will rise throughout the year. If you are in need of refinancing our have been looking to buy a new home, don’t miss the boat again – this is the time to do it.

Below are some sample rates as of this week. Pricing changes day by day ( and sometimes during the day) and can vary based on your credit score and the amount of equity you have in your home, among other factors. For more information on the current rate market, take a look at this article from the Arizona Republic.

Please call or email for a to review your current lending needs and see if I can save you some money. You may also submit an application on my website www.metrophxaz.com

Conventional $417,000 * Rate Orig Points APR

30 year fixed 4.875% 1.000% 0.000% 5.009%

5/1 ARM 3.500% 1.000% 0.000% 3.619%

FHA/USDA $200,000* Rate Orig Points APR

FHA 30 year fixed 5.000% 0.000% 0.000% 5.077%

FHA 5/1 ARM 3.500% 0.000% 0.000% 3.566%

Jumbo $1,000,000* Rate Orig Points APR

5/1 ARM 4.750% 0.000% 0.000% 4.786%

30 year fixed 5.625% 0.000% 0.000% 5.660%

*All rates are subject to change with out notice. Annual Percentage Rate (APR) calculations are base on a conventional loan amount of $417k with 20% down payment, Jumbo loan amount of $1.0m with 25% down payment, FHA loan amount of $200k with 3.5% down payment. Down Payments of less than 20% may require Private Mortgage Insurance which could increase the APR and monthly payment. Loan pricing may only be locked through a MetLife Home Loans Mortgage Consultant to be effective. All loans subject to approval. Certain conditions and fees apply. Mortgage financing provided by MetLife Home Loans, a division of MetLife Bank, N.A. Equal Housing Lender

Ever heard of a seller carry-back? Quite possibly not. The house pictured here is offered as a seller carry-back.

Ever heard of a seller carry-back? Quite possibly not. The house pictured here is offered as a seller carry-back. carry-backs and left the bank out of the equation all together. They made a private deal between the buyer and seller.

carry-backs and left the bank out of the equation all together. They made a private deal between the buyer and seller.

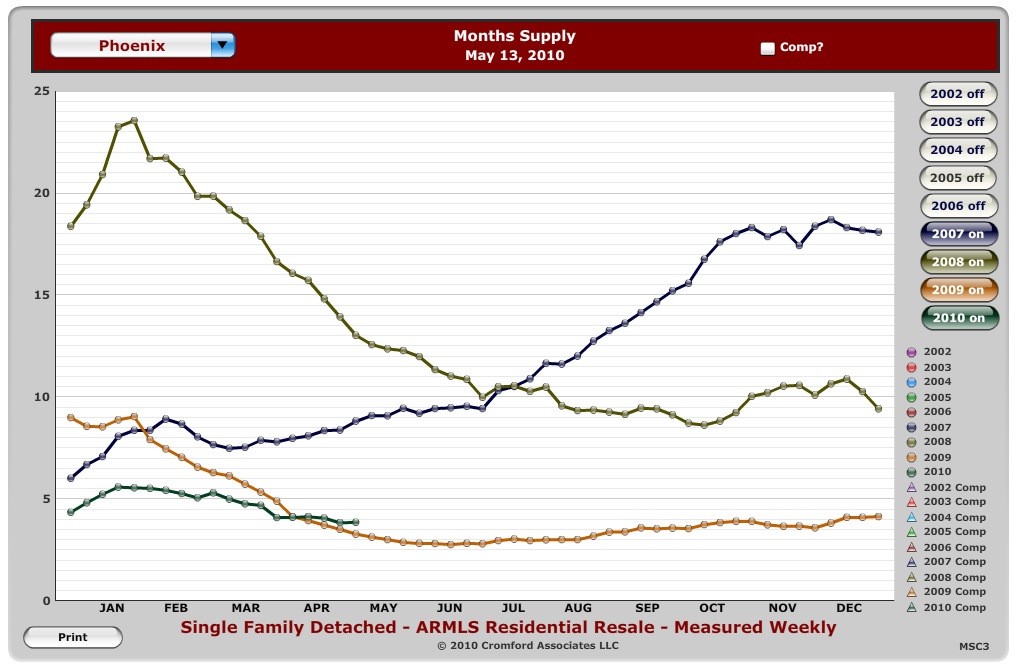

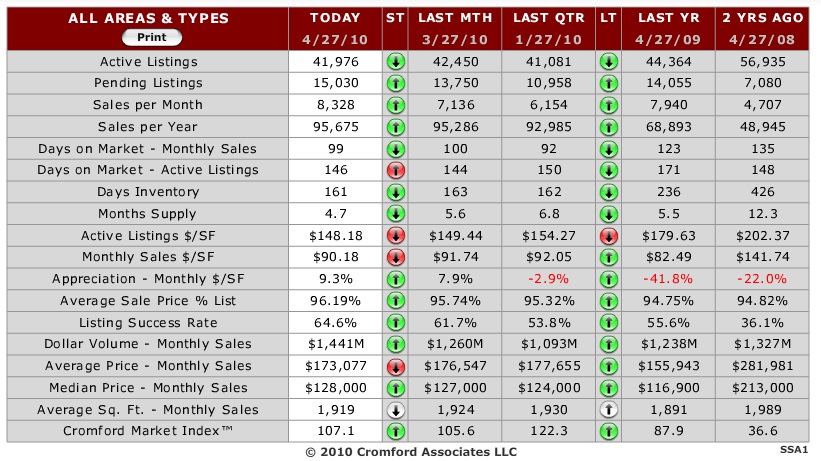

As you might guess, March was an insane month.

As you might guess, March was an insane month.

This

This  This news just in from John Hall and Associates:

This news just in from John Hall and Associates: