The Arizona Republic reported this morning that housing prices are due to drop again by 10%; such that they could be cheaper next summer than they are today.

The Arizona Republic reported this morning that housing prices are due to drop again by 10%; such that they could be cheaper next summer than they are today.

Now, I can’t read tea leaves any more than Lady GaGa would be seen wearing a polyester polo shirt from WalMart.

But there are parts of this story that you should, you know, take with a grain of salt the size of a BP oil spill.

Here is why:

#1. Using nation-wide statistics and applying them to Phoenix is like saying that the average elevation in Phoenix is 3,000 feet because that is the national average. (Note: I don’t know if there actually is a national elevation average, but you get my point.)

#2. This is not the first time that I’ve seen this narrative from the Arizona Republic. In fact, you can pretty much count on seeing an article in the next couple weeks hinting at how there might be a rebound. You know, when I was younger I had a friend who’s dog got so excited every time we came over he could not decide whether to run around or eat his food. So, he spent a half an hour trying to do both. Kinda reminds me of this.

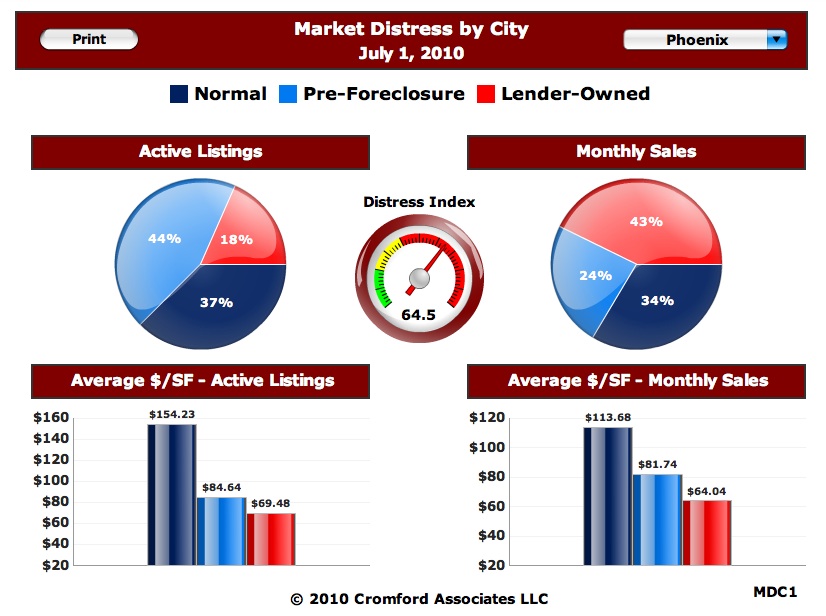

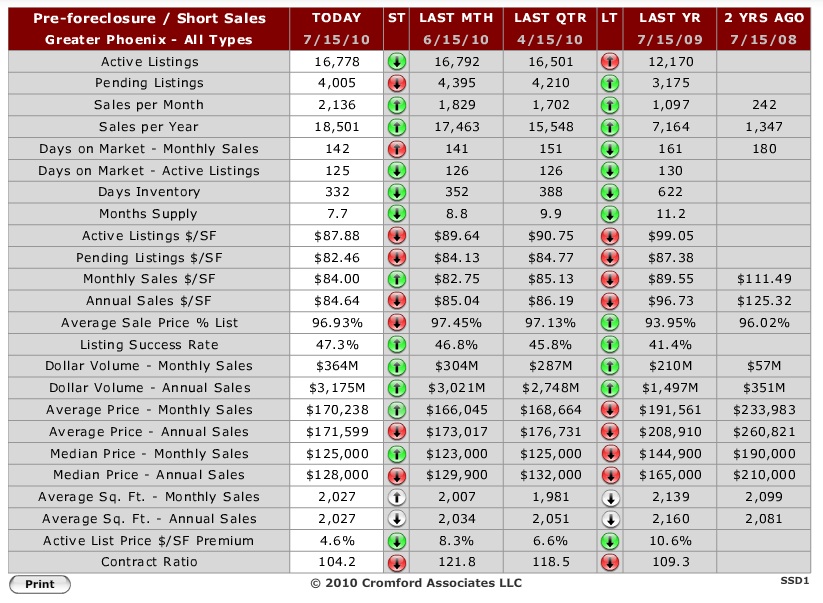

#3. They cite Mike Orr of the Cromford Report, whom I respect as an analyst, saying that prices will go down in August. I think that is probably true. But did you notice how they jump from Mike’s very local and specific analysis of one month ahead, to Moody’s very speculative analysis of next year’s prices in other cities?

#4. CenPho is not Vegas. While I work all over the valley, you know that I spend most of my time on historic neighborhoods in the central corridor. I am not seeing the same trends here that you see elsewhere. CenPho is marked by people who want to get out of the suburbs and experience a more diverse and interactive lifestyle. The price of fuel will continue to go up and people are preparing for that and choosing to live closer to work. So, this article should not lump every community together.

#5. The article says that 13% of mortgages nation-wide are late by one payment. That may be true. I don’t know. But they don’t discount how many of those folks will find work by next year and they present a worst case scenario. I don’t know about you, but when I’m making decisions, I want to know a range of likely outcomes.

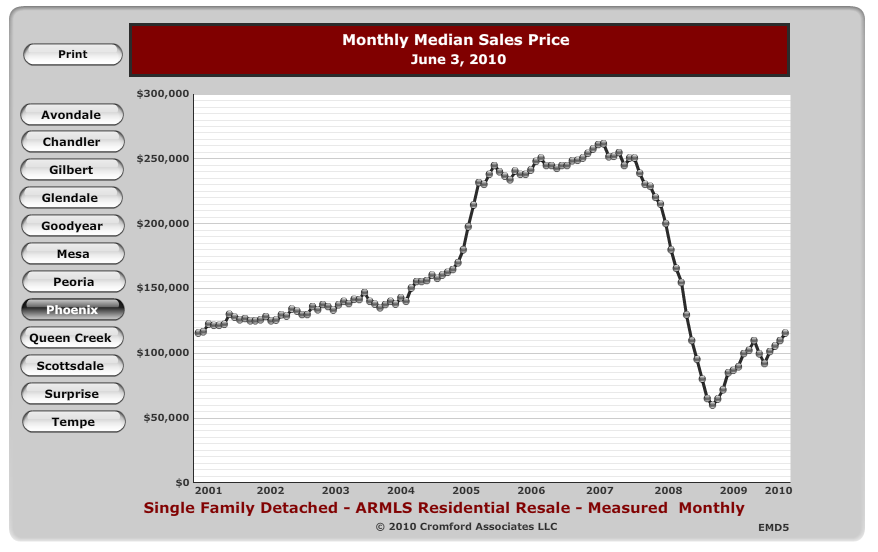

So, I don’t know what will happen 6 months from now any more than these folks do. But what I can see is that more people are calling me every day wanting to find a house. They recognize that prices are still historically low, rates are under 5% in most cases and houses are not staying on the market very long.

On thing to keep in mind: buying a house is not like playing the stock market. Don’t buy if you just want to sell tomorrow. Buy because you need a place to live and you want to build equity over time.

If you think you will stay in Phoenix for the next three years, then I would definitely feel confident that you can buy something now and probably be able to sell such that you “pay yourself rent.” Prices are so low now that the likelihood of prices going up is much greater than what Chicken Little is telling us.

I have been inundated over the last week with conflicting market news.

I have been inundated over the last week with conflicting market news. One of the things that I like about being a real estate agent is the tough code of ethics.

One of the things that I like about being a real estate agent is the tough code of ethics.