I’ve reported in the past that we as a society have so many choices that we don’t know what to do.

I’ve reported in the past that we as a society have so many choices that we don’t know what to do.

There was a book that came out a couple years ago called The Paradox of Choice by Barry Schwartz. The author spoke about how our multitude of choices actually stresses us out, rather than add convenience. It used to be that we had 5 watches to choose from at the department store. We pick one that is not perfect, but over time it becomes us. Now we have thousands to choose from and the moment we pick one we think that perhaps we picked the wrong one. The author also suggested that this might apply to our love lives, too. But, I’m not going there.

But I do believe that this is the same with real estate.

There are tens of thousands of homes out there and if you look on line its overwhelming. What do you do?

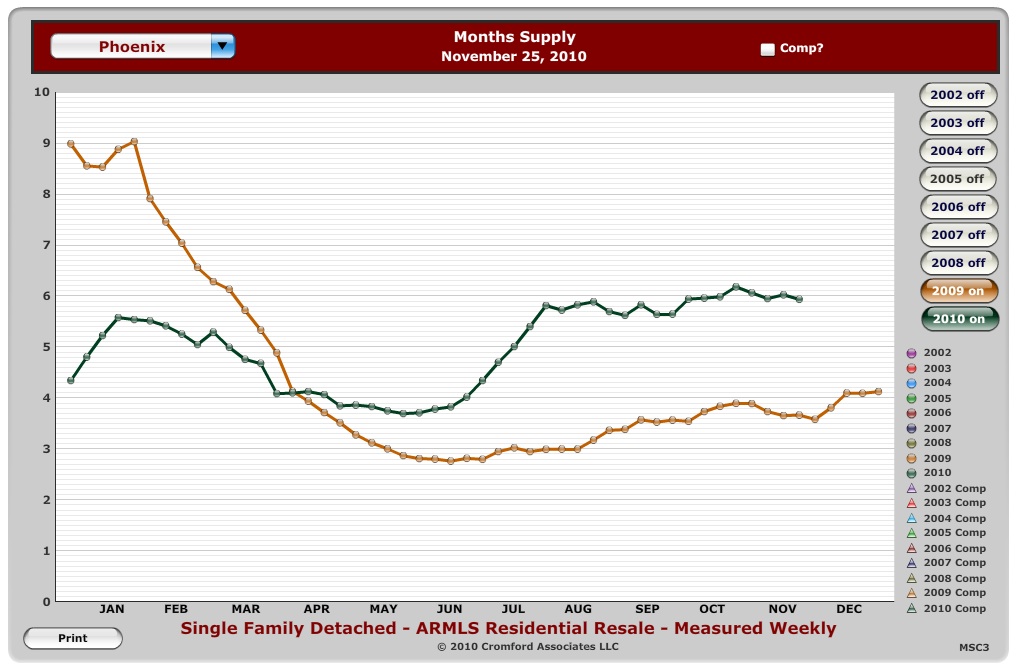

When confronted by so many choices, the first reaction may be to put off the decision. After all, interest rates are really low and you keep hearing that there are more homes ready to “flood” the market.

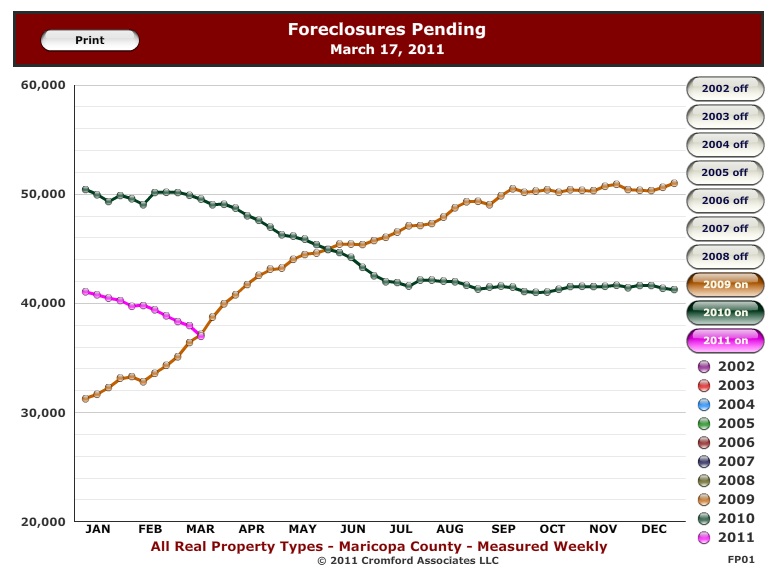

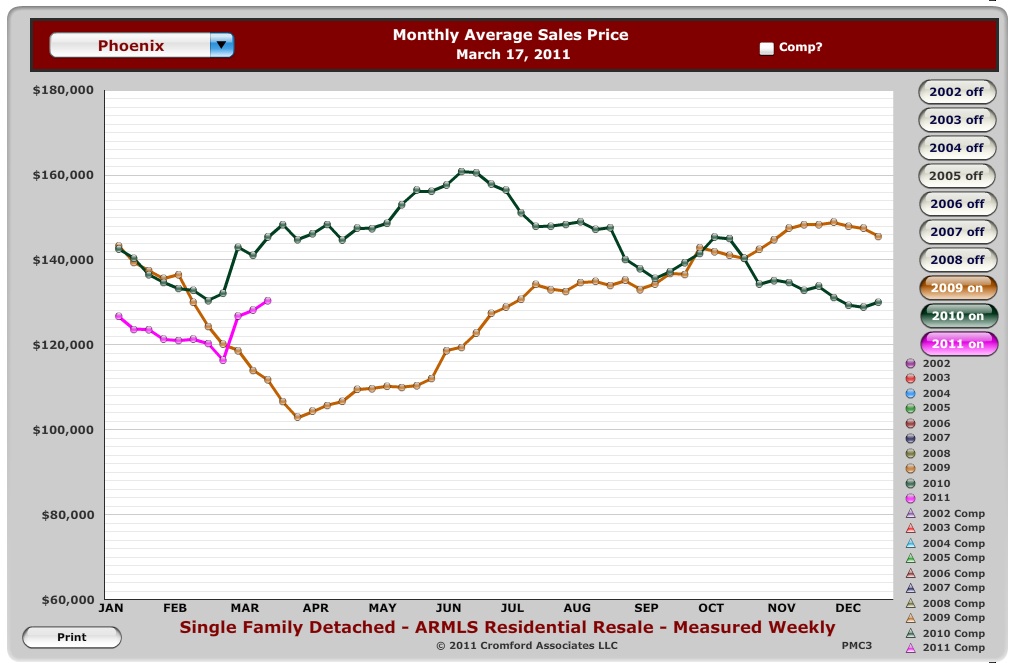

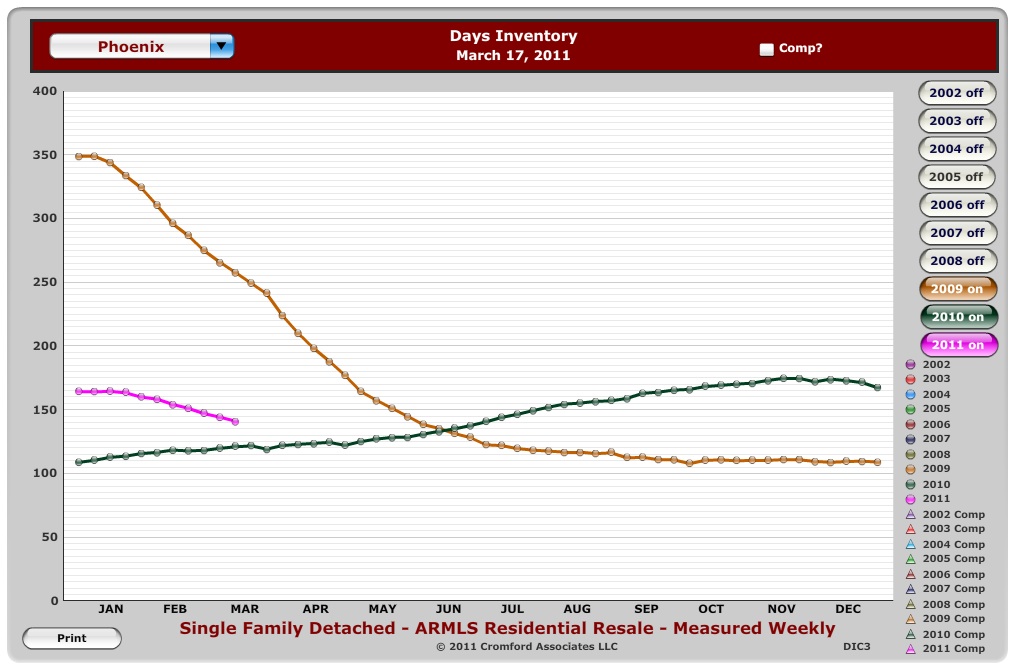

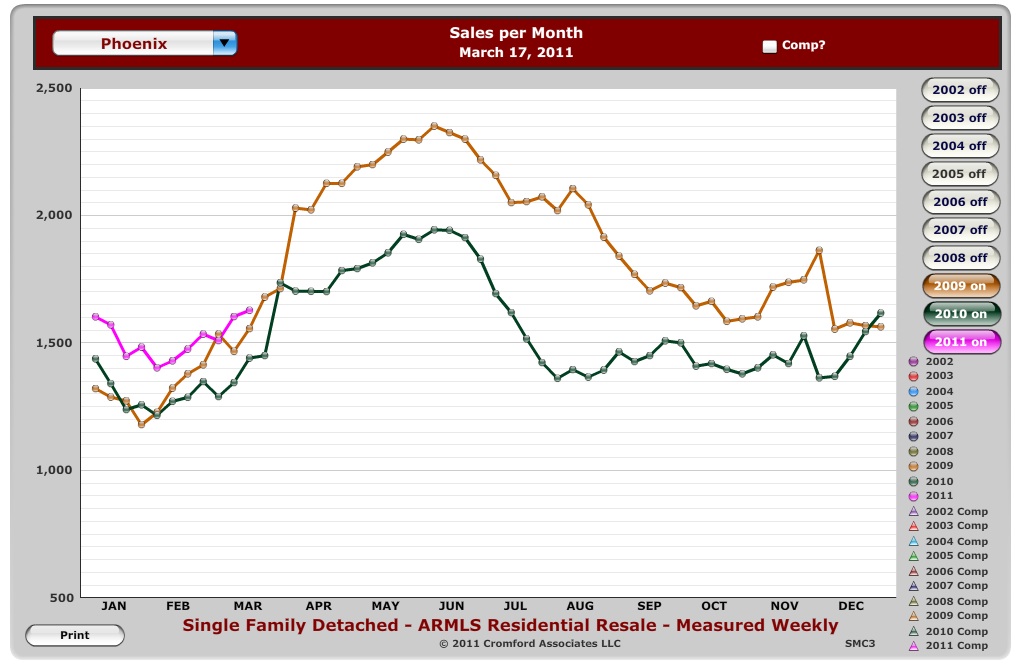

Well, interest rates just started to move up last week and I’ve covered previously in my blog why you won’t see a flood of new foreclosures in the market.

But, as for the process of choosing the best house when confronted by seemingly unlimited choice, my suggestions:

1) Before you look at even one listing, write your priorities on a piece of paper. Don’t want to renovate? Don’t want to live next to a school? Then refer to that later in the process. You list need not be unchanging, but it should serve as a guide.

2) Weed out the ones that are unacceptable, put them in a pile and don’t look at them again. They won’t get any better.

3) Split the rest among those that you really love and those that you think have some good features, but which are not perfect. Save that “imperfect” list for later.

4) As you go and see the properties in person, take lots of notes. If you are looking at homes with me, I’ll give you a clipboard with all of your listings. Make lots of notes to trigger your memory. It is easy to forget all of the details and you first impressions. After about the 5th house you see, they all blend in to one blur.

5) Don’t let the perfect be the enemy of the good. Once you’ve looked through your favorites in person and if you are not finding what you want, consider seeing ones from your “imperfect” list. The experience of looking and what you’ve learned about the neighborhoods might actually change what you consider perfect and imperfect.

6) Don’t procrastinate. Once you are in the market, see it through. If you hold off your purchase, you risk seeing the inventory of homes shrink and the interest rates go up. An imperfect house that you passed up could have been the perfect house with a little work. Or the price could have been negotiated. Then all that work will be wasted and you won’t find the house that fits your needs, despite all the choice. Now, that is irony.

Last week I

Last week I

I’ve reported in the past that we as a society have so many choices that we don’t know what to do.

I’ve reported in the past that we as a society have so many choices that we don’t know what to do.