SB1166 Fact Sheet

SB1166 Fact Sheet

Courtesy of Arizona Preservation Foundation ~ http://www.azpreservation.org

WHEN & WHERE THE SB1166 HEARING WILL BE HELD

IN PERSON: The issue is scheduled to be heard by the Senate Finance Committee on Wednesday, January 27, 2010, starting at 1:30 p.m., Senate Hearing Room 3, 1700 W. Washington St., Phoenix.

BY E-MAIL/PHONE: If you cannot attend, you can still contact a member of the Senate Finance Committee before the hearing:

The Honorable Ken Cheuvront, 602-926-5325, kcheuvront@azleg.gov

The Honorable Ron Gould, 602-926-4138, rgould@azleg.gov

The Honorable Barbara Leff, Vice Chair, 602-926-4486, bleff@azleg.gov

The Honorable Debbie McCune Davis, 602-926-4485, dmccunedavis@azleg.gov

The Honorable Richard Miranda, 602-926-5911, rmiranda@azleg.gov

The Honorable Russell Pearce, 602-926-5760, rpearce@azleg.gov

The Honorable Jim Waring, Chair, 602-926-4916, jwaring@azleg.gov

If you would like to express your views to your own State Senator or State Representative (if they are not listed above), visit http://www.azleg.gov/alisStaticPages/HowToContactMember.asp

BY REQUEST TO SPEAK IN COMMITTEE SYSTEM: The online Request to Speak in Committee System replaces sign-in slips used by those wishing to testify in Senate and/or House committees. Committee chairs will have electronic access to listings of everyone signed up to speak and will know in advance who is for or against a particular bill. To use this application, you must have registered for a user name and password at any one of the kiosks positioned outside the committee rooms on the first floor of the Arizona Senate and House of Representatives, 1700 W. Washington, Phoenix. Source: http://alistrack.azleg.gov/rts/login.asp

INTERESTING TURN OF EVENTS

One of the likely “yes” votes for SB1166 State Senator Pamela Gorman resigned, effective immediately, on Monday, January 24 to run for the U.S. House of Representatives.

A City of Phoenix P.L.A.N. Legislative E-Mail Alert on Historic Preservation was disseminated on Monday, January 24, 2010. The City’s Historic Preservation Office is recommending that the Mayor and Council oppose this bill.

PROGRAM HISTORY

Arizona State Senator Juanita Harrelson (R-Tempe) proposed the legislation in the year of our nation’s Bicentennial. According to Senator Harrelson, “I introduced the bill because I think Arizona lacks the historical background that the Eastern states have. A lot of our buildings haven’t held up, but what remains represents a time and a way that we should preserve. This bill would give owners an incentive to restore their home’s authenticity.” (Source: Arizona Republic, March 3, 1976)

Arizona’s preservation-focused tax incentive has successfully countered private and public land-use policies favoring demolition and new construction, while providing financial benefits to building owners who might otherwise feel burdened by preservation projects. The first properties joined in 1979: two in Tucson’s Armory Park and one in Prescott. Today there are approximately 6,000 homes in Arizona that qualify for this tax treatment; approximately 2,900 of them are in Phoenix and approximately 2,000 in Tucson.

BILL SUMMARY

SB1166 would repeal the reduced property tax classification for historic residential property. Under current law, qualifying historic residences are assessed at 5% rather than the 10% assessment ratio that applies to other homes — the effect of this bill would be to increase property taxes on those historic homes, approximately 6,000 throughout the state. The full bill is available online: http://www.azleg.gov/FormatDocument.asp?inDoc=/legtext/49leg/2r/bills/sb1166p.htm

ARIZONA SENATE FACT SHEET FOR SB1166 (property tax classification; historic residences)

Prepared by Senate Research Staff, January 22, 2010: http://www.azleg.gov/FormatDocument.asp?inDoc=/legtext/49leg/2r/summary/s.1166fin.doc.htm

Purpose: Removes noncommercial historic property from the class 6 property tax classification. Contains requirements for enactment and becomes effective on signature of the Governor (Proposition 108).

Background: The assessment ratio of a property establishes the percentage of the property’s value that is subject to taxation. An owner-occupied home has a 10 percent assessment ratio since it is a class 3 property. The result from applying the appropriate assessment ratio to the property value is referred to as assessed valuation. Therefore, an owner-occupied home valued by the assessor at $200,000 has an assessed valuation of $20,000. However, a noncommercial historic property, usually a historic home (class 6), has an assessment ratio of five percent. Therefore, a historic home with a value of $200,000 would have an assessed value of $10,000. The tax rate is then applied to the assessed valuation of properties.

Current statute (A.R.S § 42-12101) defines noncommercial historic property as real property in which no business or enterprise is conducted with the intent of earning a profit. In addition, the property must be listed in the National Register of Historic Places (NRHP) and meet the minimum standards of maintenance established by the Arizona State Parks Board.

According to the Arizona State Parks Board, a property must generally be fifty years old or older to be placed on the NRHP. The property must also have significance by having an association with historical events or activities, an association with an important person in history, a distinctive design or physical character, or the potential to provide important information about prehistory or history. Finally, the property must keep integrity through the maintenance of its original qualities.

S.B. 1166 removes noncommercial historic property from the class 6 property tax classification and places it into class 3. According to the Department of Revenue, in 2009 there were 5,194 non-commercial historic properties in Arizona with a net assessed valuation of $68.5 million.

The local revenue generated from the change in the assessment ratio could result in a positive impact to the state General Fund due to reduced appropriations for education equalization assistance. However, any positive impact could be mitigated by increased expenditures for the Homeowner’s Rebate Program.

Provisions:

Moves noncommercial historic property from the class 6 property tax classification to class 3.

Makes conforming and technical changes.

Requires for enactment the affirmative vote of at least two-thirds of the members of each house of the Legislature (Proposition 108).

Becomes effective on signature of the Governor.

SUGGESTIONS FOR TALKING POINTS

SB1166, in essence, is a tax increase on middle-class residential homeowners.

SB1166 ignores the substantial contribution that historic property designation has made to revitalizing and stabilizing older, blighted neighborhoods throughout our state.

Historically designated homes appreciate at a greater rate of value and sell for more than similar-sized homes in other parts of the community, according to every national and local economic impact study. But the upfront costs to restore historic residences are greater than similar-sized residences in newer neighborhoods.

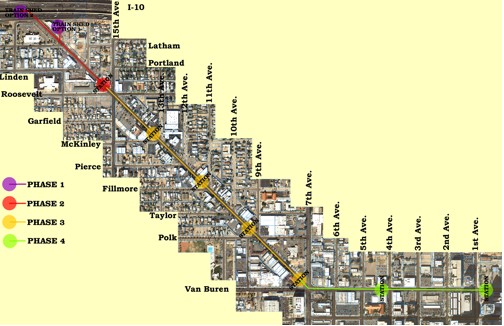

Many of Phoenix and Tucson’s historically designated neighborhoods were once blighted with many abandoned properties. Through the pioneering efforts of individuals and families who appreciate their community’s history and the economic development toolbox that includes the tax credit, these neighborhoods now offer affordable, stable, and owner-occupied housing. What was once blight is now an asset.

SB1166 represents a “quick to judge” public policy decision that could lead to broader, negative economic development ramifications in the future. Removing the tax break could put whole areas at risk. We need to continue to incentivize behavior for the good of the whole. The tax break protects neighborhoods and keeps property values higher than they would be without historic designation (assisted by the tax incentive). That promotes protection and stability.

By moving forward with the repeal of this tax credit, the Legislature will take away one of the few economic development tools available to middle class Arizonans to improve the character and safety of their neighborhoods.

If the Legislature has serious reservations about the equity of this tax credit, it should defer action on SB1166 and review it alongside a fuller spectrum of tax reform alternatives and recommendations.

ECONOMIC STUDIES

Various national studies ~ http://www.achp.gov/economicstudies.html

“Benefits of Residential Historic District Designation for Property Owners,” Jonathan Mabry, 2007 ~ http://www.box.net/shared/uldz6xb6rv

“A Cost/Benefit Analysis of Historic Districting in Tucson, Arizona,” Andy Krause, 2004 ~ http://www.box.net/shared/ypdpa63lex

Historic preservation “Grande Dame” G.G. George was highlighted in this spanning piece in Phoenix Magazine about the history of historic preservation in Phoenix.

Historic preservation “Grande Dame” G.G. George was highlighted in this spanning piece in Phoenix Magazine about the history of historic preservation in Phoenix.

Join your host committee for the annual Solstice Eve to support our friends on Roosevelt Row in Downtown Phoenix.

Join your host committee for the annual Solstice Eve to support our friends on Roosevelt Row in Downtown Phoenix.

SB1166 Fact Sheet

SB1166 Fact Sheet

Regular contributor of topic ideas of my blog, John Bennett, sent me this

Regular contributor of topic ideas of my blog, John Bennett, sent me this  Kimber Lanning is one of the most interesting people in the state right now, and her organization Local First AZ is one of the most promising groups for our future.

Kimber Lanning is one of the most interesting people in the state right now, and her organization Local First AZ is one of the most promising groups for our future.