Last month I wrote about the possibilities of commuter and passenger rail in Phoenix and Arizona. While deciding which tracks to use for these trains would be complicated, it was really the up-front costs that keep Arizona from moving toward the future in this regard.

But one man is trying his best to move the train down the track on a smaller scale –one which could still help encourage the growth of more expansive rail use in Phoenix.

But one man is trying his best to move the train down the track on a smaller scale –one which could still help encourage the growth of more expansive rail use in Phoenix.

Robert Graham wants a trolley on Lower Grand Avenue and he isn’t waiting for a government agency to get around to it. He has been quietly making the rounds and building alliances around a proposal for a short-run trolley car line that would cost in the low millions –cheaper than most new roads with greater economic impact.

He calls it “GARP”, the Grand Avenue Rail Project.

His local focus and realistic vision makes me think that we just might be able to pull it off in the near future.

Here is the skinny:

Graham (not the guy in the picture, above) is the the Principal Architect at the Motley Design Group, a design firm that has done a number of historic preservation projects around Arizona and Phoenix.

Graham, knowing that there used to be rail on Grand Avenue decades ago, looked out on the old road from his desk at his firm and asked “why not now?”

He saw the potential for a short-run trolley that serves as transportation, a local attraction and a way to support all of the businesses along “Lower” Grand Ave., from Van Buren to Roosevelt.

If you’ve ever been on Grand, you know that most of the old buildings there are perfect for a future business and shopping district –no master planning necessary. The buildings are close to the street, with street parking and lots of broad, traditional facades.

Graham was inspired by the Old Pueblo Trolley that runs on 4th Avenue in Tucson, and which helped revitalize that street. And in his position as an architect working in Phoenix for decades, he could see how all of the pieces could fit together.

Graham was inspired by the Old Pueblo Trolley that runs on 4th Avenue in Tucson, and which helped revitalize that street. And in his position as an architect working in Phoenix for decades, he could see how all of the pieces could fit together.

Piece #1: The Phoenix Street Railway Museum. A small group of rebels against the growing freeway culture bought one of the last remaining bodies of an original Phoenix streetcar in 1975. Since that time, working out of a streetcar “barn” at the Ellis-Shackelford house in downtown Phoenix, they have restored one car to working order and are working on a second. In other words, we have the vehicle.

Piece #1: The Phoenix Street Railway Museum. A small group of rebels against the growing freeway culture bought one of the last remaining bodies of an original Phoenix streetcar in 1975. Since that time, working out of a streetcar “barn” at the Ellis-Shackelford house in downtown Phoenix, they have restored one car to working order and are working on a second. In other words, we have the vehicle.

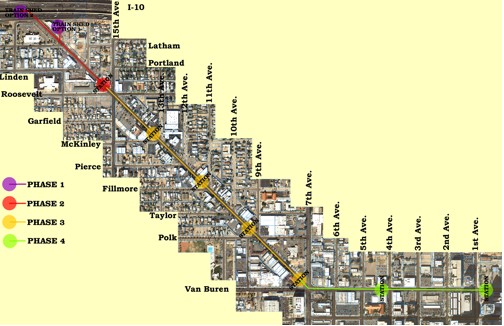

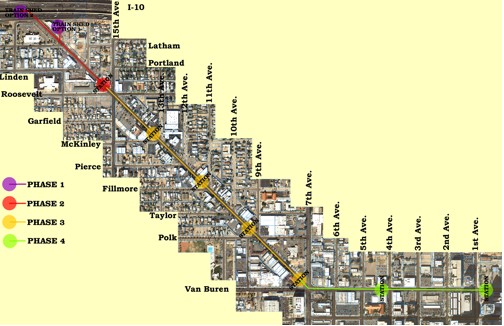

Piece #2: Storage and right-of way. Graham points to acres of unused space under the I-10 freeway at 15th Avenue and Grand that could be used as storage, maintenance and a kind of small switch yard for one or two cars. See the map, below.

Piece #3: Business Support. The fledgling Grand Avenue Merchant’s Association (GAMA) fully supports the idea of a street car line along Grand Ave., and one property owner has suggested lending space for a streetcar museum. The problem: “fledgling” means they have no money to do it themselves.

Piece #3: Business Support. The fledgling Grand Avenue Merchant’s Association (GAMA) fully supports the idea of a street car line along Grand Ave., and one property owner has suggested lending space for a streetcar museum. The problem: “fledgling” means they have no money to do it themselves.

Piece #4: Institutional Support. Graham is looking for support from the city to consider plans to lay track along the middle lane of Grand Ave. This track, unlike the new light rail track, is relatively cheap to install. There are no expensive curbs and extra signals. While Graham suspects that the streets and transportation planners at the City might worry about reducing the car carrying capacity of Grand Ave., he looks forward to conversations about how to make it work.

He sees the work in four potential phases, starting with moving the train cars to a new storage yard under I-10, along with a small trolley museum (about $500,000). Phase 2 and 3 lays tracks from the I-10 south to Van Buren (another million dollars). A potential Phase 4 could then connect Grand Ave. to the light rail station at 1st Ave and Van Buren –the most complicated and costly phase.

However, this last phase would mean that you could ride the modern light rail in from the burbs, jump on the old Trolley and visit all the galleries and sites that will inevitably populate Grand Ave. Now, that’s economic development.

Photos Courtesy of Motley Design Group

Photos Courtesy of Motley Design Group

While Graham admits that his cost estimate are very preliminary and “pulled out of the air,” he is hopeful about getting start-up funds from what are called T-21 Transportation Grants, through ADOT.

According to Graham, the grants are extremely generous, needing only a 5% match to get funding. That’s $25,000 to get a $500,000 grant.

Grant is looking for help with his idea. While he is still making the rounds to get critical political and bureaucratic support, he also needs volunteer grant writers, fund raisers and advocates. If you are interested in joining in the cause, contact Grant at trolley@motleydesigngroup.com.

I’ve lived in several cities with this kind of trolley system in place and I think Graham’s vision is perfect for the times. While it will be tough to get the kind of money to get started, this is the kind of “low dollar” project, that if started soon, could be in place in time for the next big boom in downtown redevelopment.

It could secure Grand Avenue’s identity as a historically significant, locally-owned alternative to the mega-mall.

The Coronado Historic Neighborhood is almost exclusively bungalow style homes with great big porches and lots of cool architectural features.

The Coronado Historic Neighborhood is almost exclusively bungalow style homes with great big porches and lots of cool architectural features.

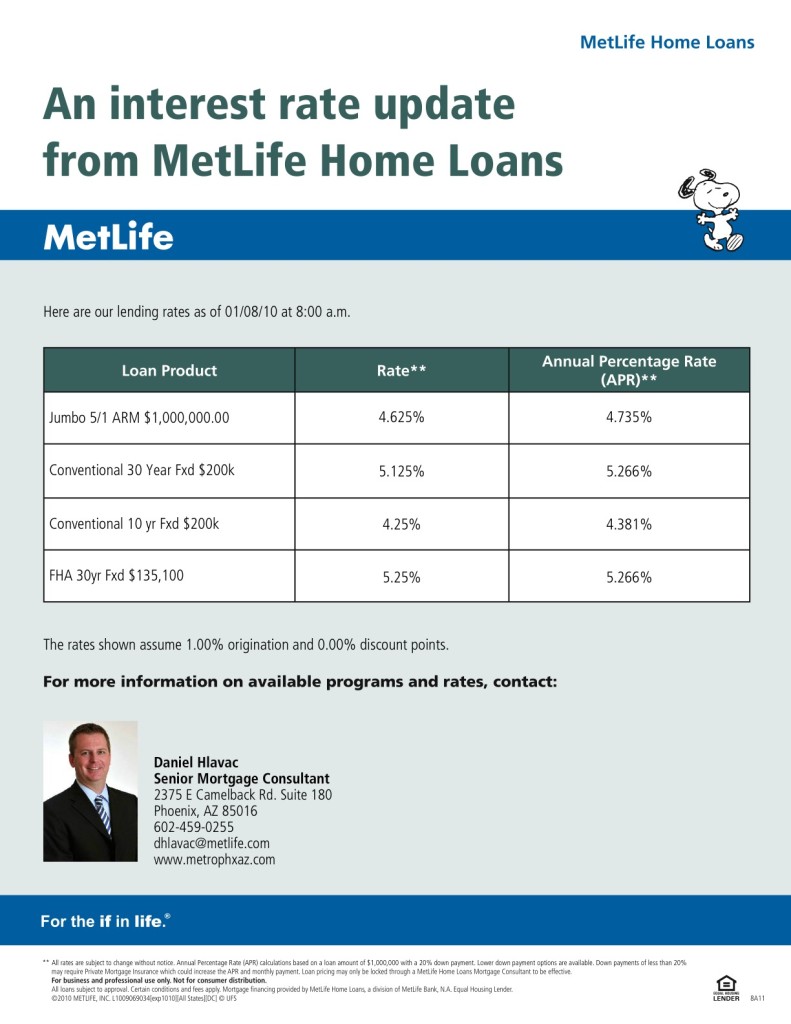

If you are a first-time home buyer, you may be affected by an increase of fees to secure an FHA-backed loan.

If you are a first-time home buyer, you may be affected by an increase of fees to secure an FHA-backed loan.

Regular contributor of topic ideas of my blog, John Bennett, sent me this

Regular contributor of topic ideas of my blog, John Bennett, sent me this

Kimber Lanning is one of the most interesting people in the state right now, and her organization Local First AZ is one of the most promising groups for our future.

Kimber Lanning is one of the most interesting people in the state right now, and her organization Local First AZ is one of the most promising groups for our future.