This from the Historic Neighborhoods Coalition…

Will Phoenix Abandon Its Historic Neighborhoods?

Sources at City Hall indicate that the movement progresses to make the Historic Preservation Department a part of a larger department. An appropriate department combination would be Historic Preservation with Community and Economic Development. As a nationally recognized asset to Phoenix, our historic neighborhoods have proven their economic value with the Home Tours and the Historic Neighborhoods Map utilized by many in the community.

Sources at City Hall indicate that the movement progresses to make the Historic Preservation Department a part of a larger department. An appropriate department combination would be Historic Preservation with Community and Economic Development. As a nationally recognized asset to Phoenix, our historic neighborhoods have proven their economic value with the Home Tours and the Historic Neighborhoods Map utilized by many in the community.

While the Historic Preservation Office (HPO) may no longer be able to be an independent Department, under no circumstances should it be combined with the new DSD/Planning. An attorney has said that his zoning attorney colleagues are basically “licking their chops” over this proposed combination.

Without a strong commitment to preservation on the part of the City Manager’s office and the Mayor and Council, the stability of the historic neighborhoods and the economic progress we have generated in the last decade will be lost.

Historic Preservation is good business, a proven Community and Economic Development driver, and should be recognized as such in any reorganization.

While there is still time, we are asking every neighbor to please send the above message by email or calling the following:

City Manager David Cavazos david.cavazos@phoenix.gov 602-262-7958

Deputy Manager David Krietor david.krietor@phoenix.gov 602-262-7957 or

His direct line for messages 602-262-6853

Executive Assistant to the City Manager Lisa Takata lisa.takata@phoenix.gov

602-262-6941

Mayor Phil Gordon mayor.gordon@phoenix.gov 602-262-7111

Vice Mayor Michael Nowakowski council.district.7@phoenix.gov 602-262-7492

Councilwoman Thelda Williams council.district.1@phoenix.gov 602-262-7444

Councilwoman Peggy Neely council.district.2@phoenix.gov 602-262-7445

Councilman Bill Gates council.district3@phoenix.gov 602-262-7441

Councilman Tom Simplot council.district.4@phoenix.gov 602-262-7447

Councilman Claude Mattox council.district.5@phoenix.gov 602-262-7446

Councilman Sal DiCiccio council.district.6@phoenix.gov 602-262-7491

Councilman Michael Johnson council.district.8@phoenix.gov 602-262-7493

Immediate action is necessary to protect our historic neighborhoods.

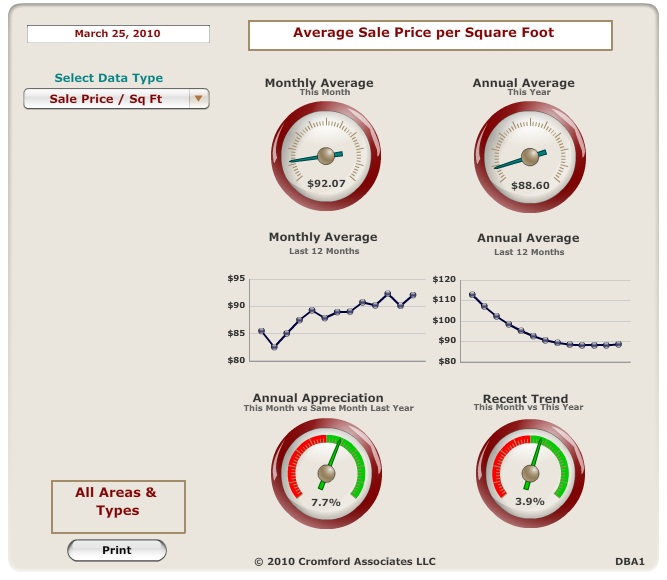

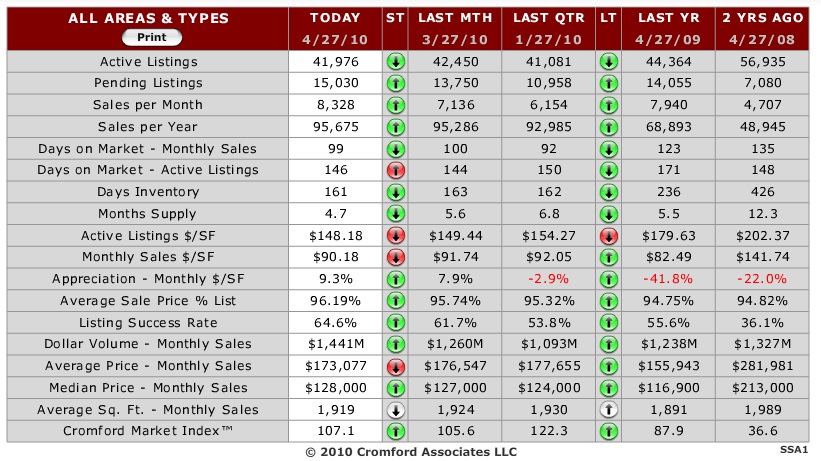

As you might guess, March was an insane month.

As you might guess, March was an insane month.

I remember standing in Melbourne, Australia a few years ago. This city has everything: live music, art, theater, gardens, food, etc. I was thinking about whether I should move there. Luckily I did not.

I remember standing in Melbourne, Australia a few years ago. This city has everything: live music, art, theater, gardens, food, etc. I was thinking about whether I should move there. Luckily I did not.

This

This  This news just in from John Hall and Associates:

This news just in from John Hall and Associates: Really. It’s going away. The $8,000 first time home buyer and the $6,500 repeat home tax credits will not longer be available after the end of April. So, set your clocks!

Really. It’s going away. The $8,000 first time home buyer and the $6,500 repeat home tax credits will not longer be available after the end of April. So, set your clocks!