Globally Acclaimed Event Makes its Phoenix Debut at Downtown’s Historic Icehouse

SATURDAY, APRIL 30, 2011

THE ICEHOUSE | 429 W JACKSON ST, PHOENIX AZ 85007

7pm Potluck | 9pm Slideshow

FOR IMMEDIATE RELEASE Phoenix, AZ (March 24, 2011) Slideluck Potshow’s singular mashup of art and food makes its Phoenix debut with a twist … a farmers market collaboration with the Phoenix Public Market. PHOENIX PUBLIC MARKET is a program of Community Food Connections (CFC), a non-profit that provides fresh, locally grown produce and foods at downtown’s Urban Grocery and Wine Bar and Wednesday/Saturday open air farmers’ market at Central Avenue and Pierce Street.

SLIDELUCK POTSHOW, a New York City-based non-profit arts organization, brings together arts-appreciators and foodies for an unforgettable evening. Phoenix co-producer Kristin Altman explained, “The event began in a Seattle backyard ten years ago and now spans the globe to cities including London, São Paolo, Milan, L.A., Barcelona, Chicago, Mexico City, Stockholm, Rome, Washington DC, New Orleans, San Francisco, Madrid, Berlin, New York, Paris, and more. As a Phoenix native, I’m excited to make our mark.”

The night begins with mingling and dining on the home-cooked dishes of attendees. Then the lights go down, the crowd is hushed, and a stunning slideshow begins. Attendees are encouraged to use ingredients from the Phoenix Public Market … pick up some vegetables, fruits, meats, breads, cheeses, pastas, or other goods at the farmers’ market or Urban Grocery and Wine Bar the week of the event and use it in your potluck dish … doing so gets you $5 back at the door.

CFC’s executive director Cindy Gentry and her supporters have made it their mission to increase access to fresh, nutritious food in underserved areas, promote economic development opportunities for farmers and micro-businesses, and provide a community gathering space that celebrates Phoenix’s cultural diversity. Dispelling the notion that fresh food is a luxury, Gentry keeps prices low and has empowered customers to use food stamps. A champion of all things local, her work is a testament to the values of simplicity, value, and community. “We’re excited about tying food and art together at this event,” Gentry said. “People who appreciate the art of a good, hearty meal often find pleasure in the visual arts as well. This event is about exploring all those senses. It fits with the food movement. It’s a sign of our times.”

Davin Lavikka, owner of Method Art gallery in the Scottsdale Arts District, and Wayne Rainey, owner-partner of Bokeh Gallery downtown Phoenix, are curating the art submissions. Artists featured will be a captivating mix of the accomplished and the up-and-coming. Lavikka enthused, “I’m thrilled to be part of this. We’ll be bringing all types together – supporters of the arts, food enthusiasts, students, people eager for a different kind of night out. Sitting at the historic Icehouse surrounded by friends, in front of the glowing screen, taking it all in – this is what the arts are all about.”

CONTACT: Kristin Altman 323 807 8430 & Richard Ross 773 343 5696 / slpsphoenix@gmail.com

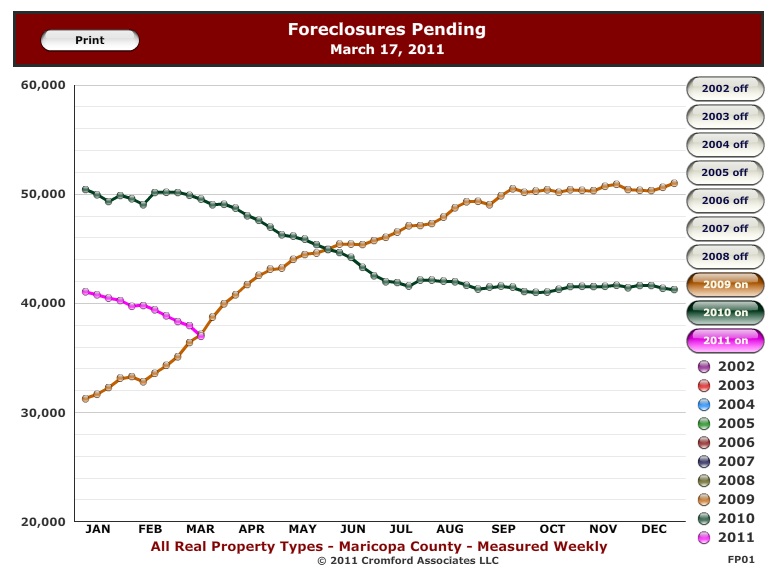

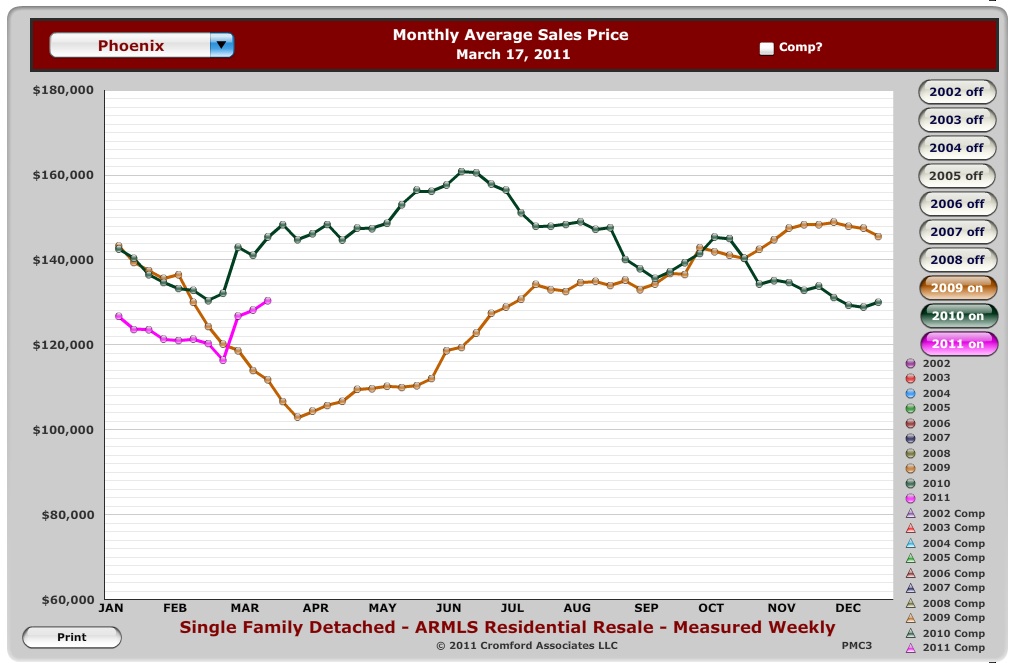

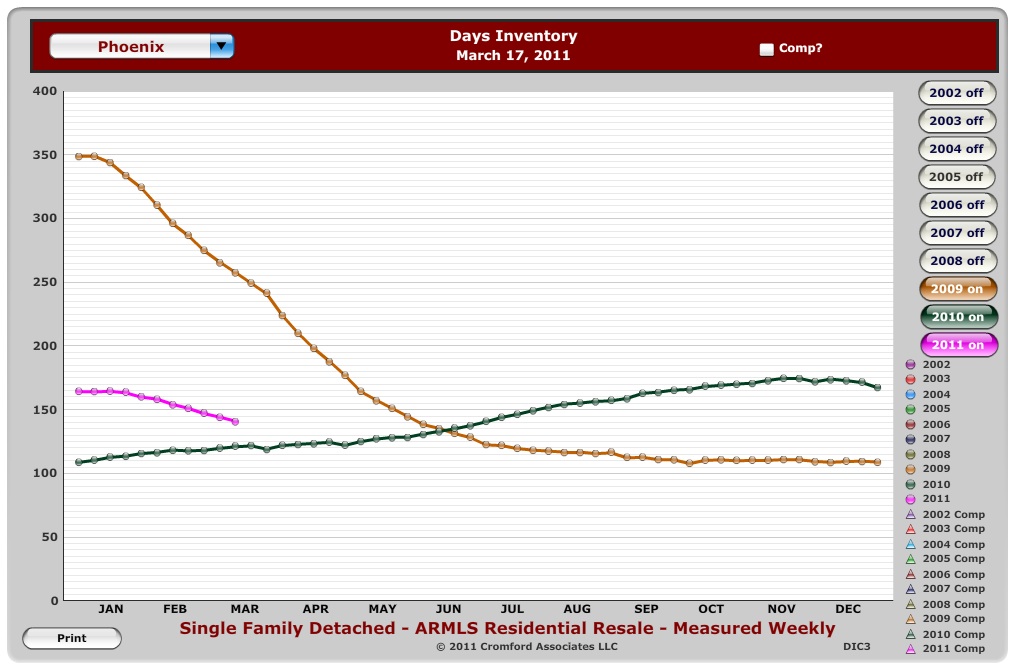

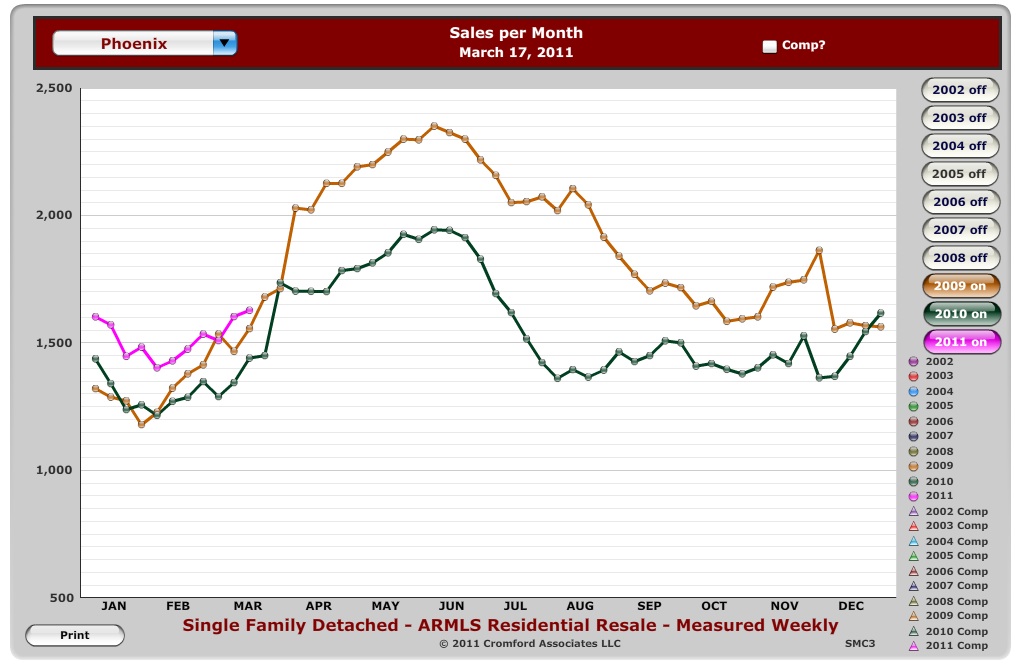

This data comes from my friends at Old Republic Title and Escrow and pertains only to the single family detached market (i.e. not condos, patio homes or townhomes).

This data comes from my friends at Old Republic Title and Escrow and pertains only to the single family detached market (i.e. not condos, patio homes or townhomes).

Last week I

Last week I