August Tight Market News

We can expect more tightness in the market, as we move in to August and September.

Not a shocking theory, I know. For those of you who have read this blog for a while, you know that there is a rhythm to the market that happens throughout the year, regardless of whether it is a high or low market.

From February until the end of June there are more buyers and sellers relative to other parts of the year. It cools from July until September. Then we begin the second heaviest season, which ends around Thanksgiving. Then people almost totally disappear until January.

Get ready for the more buyers beginning in late August or September.

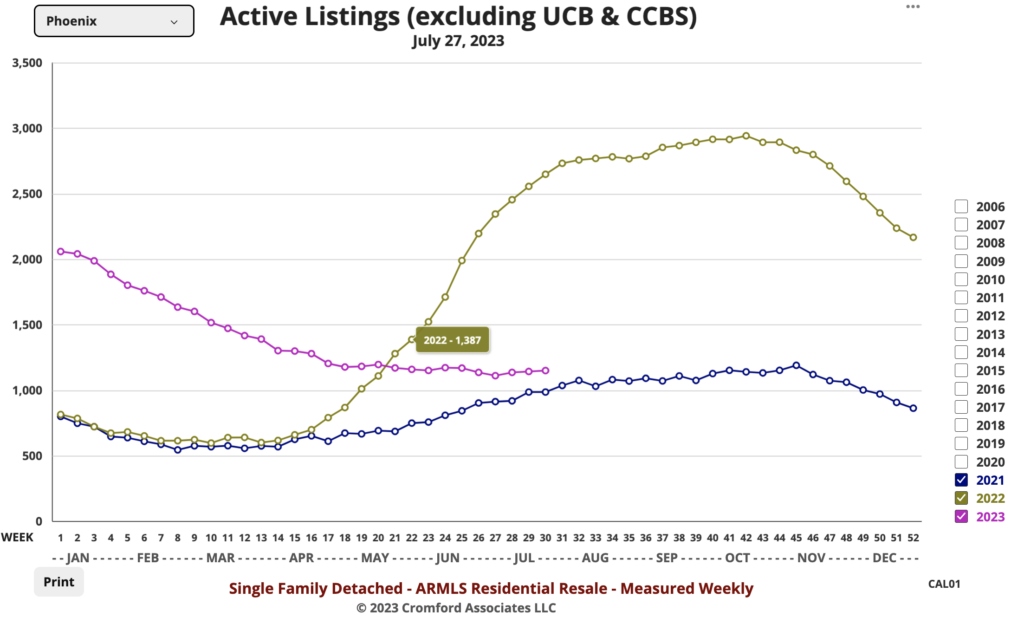

The problem is that, if you look at inventory you can see that inventory has been dropping, and may flatten towards the end of the year. As I see it, buyers will come on when the nights begin to cool off, but any increase in inventory won’t be enough to balance the demand.

In short, if you are thinking of selling, listing in September will be a good time to do it. If you have repairs to do on your home to prepare it for sale (remember, you are competing against total renovation homes), then now is the time to start planning.

Here’s what the folks at the Cromford Report have to say about where we are…

ARMLS numbers for August 1, 2023 compared with August 1, 2022 for all areas & types:

- Active Listings (excluding UCB & CCBS): 11,241 versus 17,957 last year – down 37% – and down 2.6% from 11,545 last month

- Pending Listings: 4,842 versus 5,291 last year – down 8.5% – and down 3.1% from 4,997 last month

- Under Contract Listings (including Pending, CCBS & UCB): 7,546 versus 8,058 last year – down 6.4% – and down 4.0% from 7,858 last month

- Monthly Sales: 5,906 versus 6,190 last year – down 4.6% – and down 21% from 7,452 last month

- Monthly Average Sales Price per Sq. Ft.: $282.34 versus $286.03 last year – down 1.3% – and down 1.9% from $287.78 last month

Comparisons with this time last year continue to get easier, as a year ago the market was deteriorating quickly as institutional investors and iBuyers pulled out of the market.

Now we have a re-sale market which is plodding along slowly with poor demand and weak supply. There is little to get excited about unless you are in the new home construction business. At the time of writing the typical 30 year fixed mortgage rate is up to 7.20%, so affording to buy a home just got a little harder. Selling an existing home with a mortgage looks even less attractive, so new MLS listings are arriving in very low numbers, as they have done all year.

Some badly informed observers still think there is a bubble popping situation ahead, but they completely misunderstand the situation. For prices to fall, we have to have an excess supply compared to demand. Even though demand is very weak, supply actually got 2.6% smaller over the last month. There is very low delinquency in residential real estate lending right now, so it takes a ridiculous leap of great imagination to believe that foreclosures are going to have any significant effect on supply in the foreseeable future.