A Note on the Tax Credit and Foreclosures

You may have heard in the news about an extension of the tax credit for first time home buyers. I’ve not really covered this because it really only applies to people who are in escrow.

I don’t think the media was clear enough about this: the only thing they were extending was the time you have to close. Remember the tax credit two-step? You had to get an offer accepted by April 30th and the house closed by June 30th? Well, all they are extending is the deadline to close.

So, basically, of the 17,000 properties that are in escrow right now in Maricopa county, fewer of them will cancel because somebody found that they were not in time for the tax credit.

Oh well June still has, at this time 9,083 closed, that’s basically the same as May, but down about 3% from June 2009. REO and Short Sale (SS) trends continue, namely REO’s are dropping (36%) in number and SS are increasing (25%).

According to my broker, Jim Sexton, the number of foreclosures, at 6,170, is the lowest number since 4/08. The change in the Pending Foreclosure numbers was the largest drop on record at 2,673, the lowest since 3/9.

In other words, the market is beginning to clear of the foreclosed properties, slowly but surely. This is for two reasons. First, banks and brokers are getting faster at selling short sale properties. Second, the number of distressed properties may be simply going down.

This picture is not completely clear yet, but we will see soon.

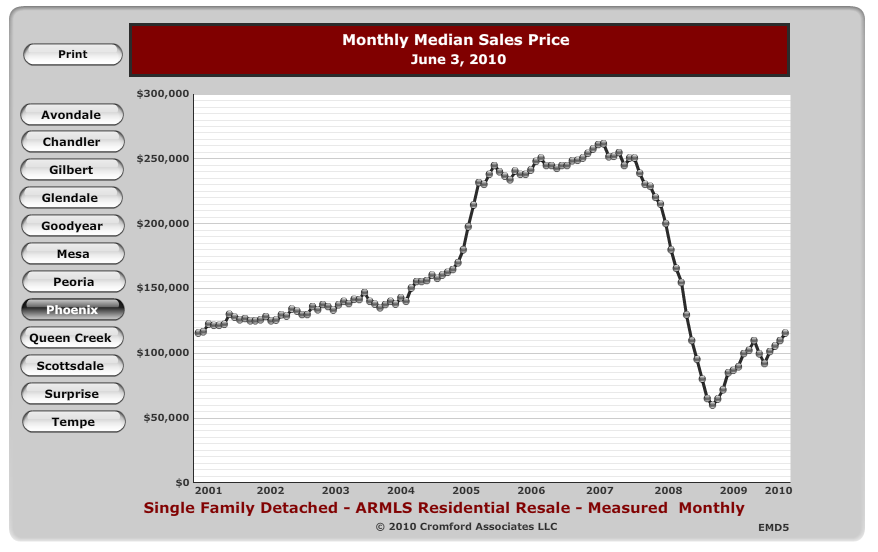

This supports what we are seeing: that sales prices are inching upward as the market clears. We are back at 2001 levels, on average (but better in most Central Phoenix or historic neighborhoods.)

This is still a great time to buy a house, with rates still hovering at or below 6% APR.

Leave a Comment