A Balanced Market?!

When I say “a balanced market”, you might think of a tranquil lake with slight ripples splashed with moonlight.

Or, maybe not. I mean, that was really specific

But, what we mean by “balanced market” has more to do with the buyers’ and sellers’ relative advantage.

Where things stand now, the Cromford Index is hovering right around 100 –the point at which neither seller nor buyer have an advantage. If it continues to drop below 100, watch for price reductions in order to sell a home.

In other words, if you are thinking of selling, do so now or wait for another 18 months to a year for the market to recover.

If you are a buyer, you now have so many more options for homes. You are not in a market where you can offer 10% less and the seller will accept your offer with a smile and a home-made banana nut muffin.

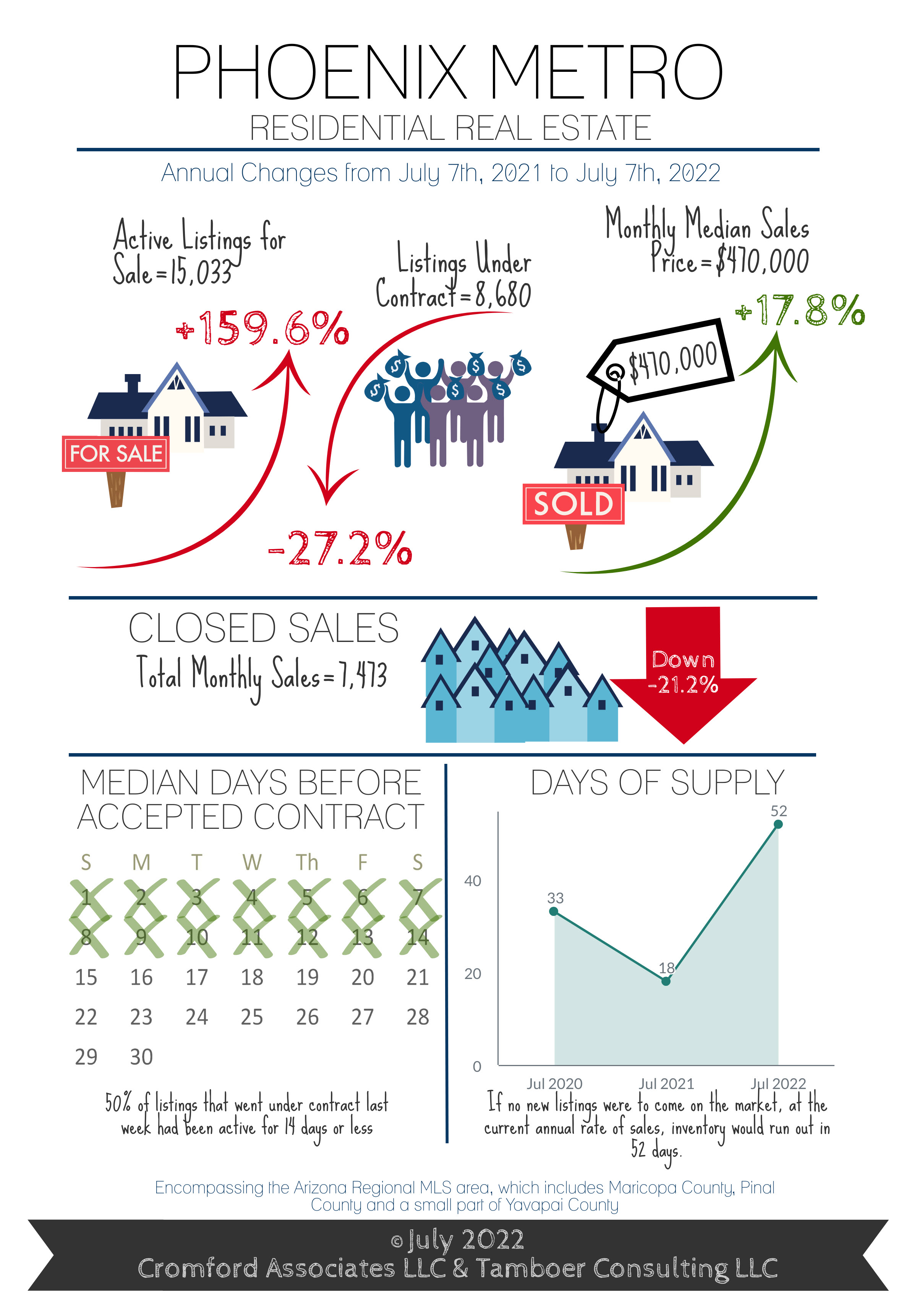

But, seriously, have a look at this graphic snapshot of July. The number of active listings is up 159% from this month last year — the majority of this climb in just the last few months.

Here’s what the data nerds over at the Cromford Report have to say about where we are:

For Buyers

“Welcome to a balanced market, how quickly the tables have turned! While seller markets are ideal for the not-so-perfect home, balanced markets are ideal for the not-so-perfect buyer.

This means that buyers who have been recently rejected due to lower down payments, non-conventional financing, or need for closing cost assistance will find sellers are now willing to work with them in this new environment.”

For Sellers

“The proverbial ‘Dump Your Junk’ season is over, that loving phrase the industry uses when demand is significantly higher than supply and even the smelliest dilapidated property gets multiple offers over asking price. That is no longer the case as of this writing. Get ready for longer marketing times, multiple price reductions, Realtor® tours, price opinions, staging, repairs, seller-paid closing costs and price negotiations. The extreme seller market is over.

It’s no surprise that the market has been shifting since February, with the primary influence being large mortgage rate increases. However, over the past 6 weeks mortgage rates have been particularly volatile, fluctuating from 5.1% to 5.8% within 3 weeks only to drop to 5.3% over the next 2 weeks, and then back up to 5.8% a week later. History tells us that buyers do not like sharp, rapid fluctuations in mortgage rates. It causes buying activity to freeze until a level of stability and certainty can be achieved. This market is no different, contract activity has dropped 28% in the last 6 weeks. The number of listings under contract at this time of year should be around 10,000, putting today’s count of 8,680 well below normal.”