Heading in to the summer, we see conditions over the last month that we would expect to see as it heats up. They market is the busiest from about February until late June. Then things pick up again in late August until Thanksgiving.

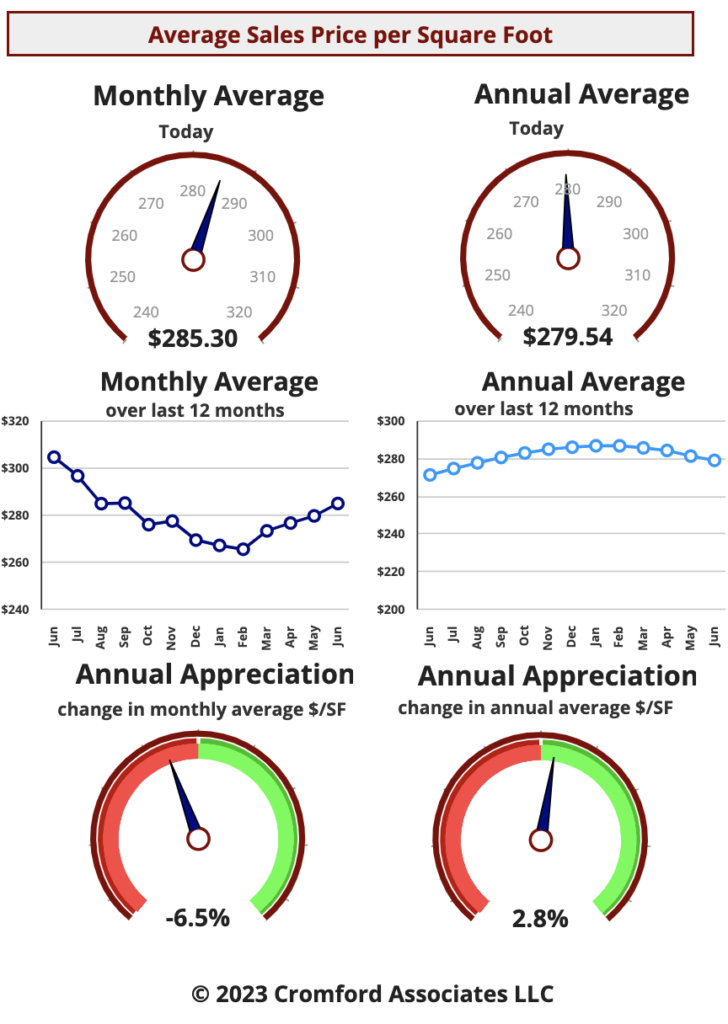

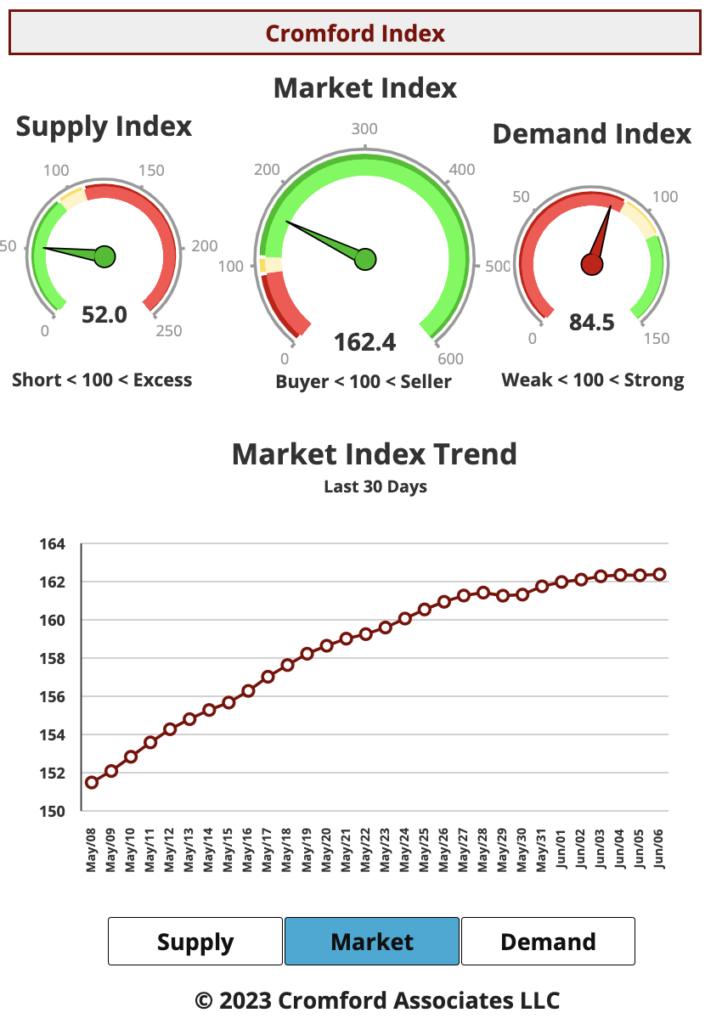

These data points from the Cromford Report support what we are seeing anecdotally. We continue to suffer the consequences of high interest rates and out-of-control institutional investors and prices remain pretty close to what we saw last year.

If you were waiting for a drop in prices, that was last year. Inventory is still low enough that prices are not likely to come down. People are finding ways around the high interest rates to get in to the homes they want. They are re-entering the market and dealing with similar shortages.

To quote Cromford:

“Here are the basics – the ARMLS numbers for June 1, 2023 compared with June 1, 2022 for all areas & types:

- Active Listings: 11,730 versus 9,439 last year – up 24% – but down 6.2% from 12,503 last month

- Pending Listings: 5,696 versus 6,887 last year – down 17% – and down 8.5% from 6,224 last month

- Under Contract Listings: 9,028 versus 10,249 last year – down 12% – and down 9.4% from 9,969 last month

- Monthly Sales: 8,082 versus 8,728 last year – down 7.4% – but up 21% from 6,687 last month

- Monthly Average Sales Price per Sq. Ft.: $283.47 versus $303.39 last year – down 6.6% – but up 1.3% from $279.76 last month

- Monthly Median Sales Price: $434,000 versus $475,000 last year – down 8.6% – but up 2.1% from $425,000 last month

This time last year, the market was in full retreat, but pricing was just a few days away from its peak of $306.46 per sq. ft., reached on June 10. Closings were still plentiful, driven by the demand from institutional investors and iBuyers who were just about to curtail their buying spree.

So much has changed in the last year. The gut-wrenching slowdown that took place in the second half of 2022 is now a distant memory and the market is slowly and cautiously recovering to a semblance of normality. Closings in June were unusually strong – up 21% from May, but these were driven by contracts signed in April when interest rates were more attractive than they are right now. A spike in mortgage rates at the end of May meant we entered June with a weak count of listings under contract, down over 9% from the beginning of May. This means we should expect relatively unimpressive closing counts for June.”

Furthermore, and it’s never fun to say that I told you so, the long-ignored need to conserve water is beginning to affect housing. Cromford again: “The recent decision to restrict future permits because of water concerns means that situation is likely to remain in place for a long time. The market will see less volume than we have become used to, but prices will be reinforced by the chronic supply.”

I’m not saying that Arizona will be unlivable in 5 years. What I am saying is that home builders and realtors –the very people who undermined efforts to save water– really need to get with it and become ardent water conservationists and density developers before they condemn all of our collective life savings to the fate of the Hohokam.