We are sharing with you the Cromford Report’s mid-May update, in its entirety because we simply can’t say it better.

Here’s the pull-quote take away: “Buyers waiting because they thought prices would fall have been left in the dust.”

We can bring this to you because we subscribe to their product. It is also what makes us better agents. Call us if you have questions about where the market is going at 602-456-9388.

Starting with the basic ARMLS numbers for May 1, 2019 and comparing them with May 1, 2018 for all areas & types:

- Active Listings (excluding UCB): 17,513 versus 16,329 last year – up 7.3% – but down 6.1% from 18,650 last month

- Active Listings (including UCB): 23,650 versus 21,440 last year – up 5.6% – but down 3.2% compared with 23,399 last month

- Pending Listings: 7,326 versus 7,393 last year – down 0.9% – but up 5.3% from 6,958 last month

- Under Contract Listings (including Pending, CCBS & UCB): 12,463 versus 12,504 last year – down 0.3% – but up 6.5% from 11,707 last month

- Monthly Sales: 9,676 versus 9,185 last year – up 5.3% – and up 13.9% from 8,496 last month

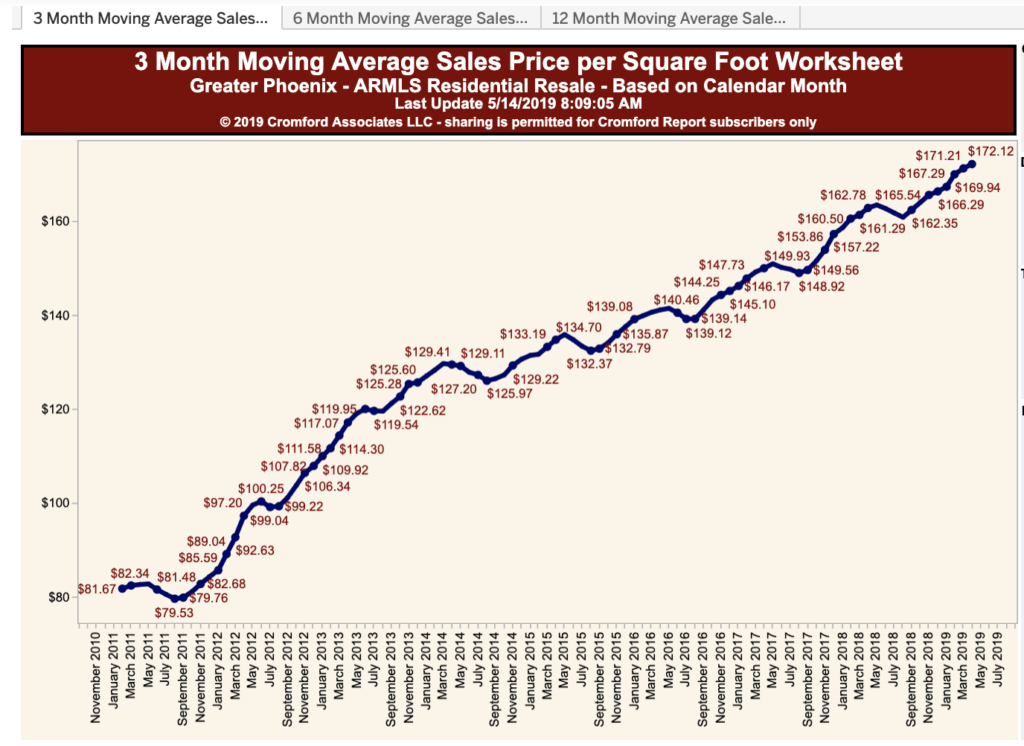

- Monthly Average Sales Price per Sq. Ft.: $171.80 versus $162.84 last year – up 5.5% – but down 0.1% from $172.04 last month

- Monthly Median Sales Price: $270,000 versus $255,000 last year – up 5.9% – and up 1.5% from $266,000 last month

Last month we saw strong growth in listings under contract. This month we see strong growth in closed listings. This is why listings under contract is such an important number – it gives us early warnings of a change in the market. On this occasion the change is strongly positive for sellers. Sales are not only recovering, they actually exceeded April 2018 by 5.3%. Now those in the know are aware that April 2019 had a 4.8% advantage over April 2018, because it contained 1 additional working day. Many people tend to forget how significant the number of working days can be in retarding or advancing sales counts. But even allowing for that unfair advantage, April returned higher sales per day than April 2018. In fact April 2019 was the strongest month since 2005 for unit sales.

Currently the listings under contract count is almost the same as last year, so we should expect closed sales in May 2019 to be similar to May 2018. Both have 22 working days so this will be a fair fight.

New listings have been flowing a little more freely since March – we know sellers get encouraged by lower interest rates as well as buyers. However the new higher level of demand is making short work of the extra supply and active listings without a contract dropped over 6% during April. Supply is higher than last year, but it is falling more quickly than it did in 2018.

As we predicted, prices are rising, but at a slower pace than in 2018. The median sales price was up 5.9% compared with a year ago, while the average $/SF was up 5.5%.

Buyers waiting because they thought prices would fall have been left in the dust. The market continues to strengthen and the likelihood of falling prices in the near term is minimal. We have extremely low levels of distress, chronic low supply and the best buyers can hope for is that the appreciation rate will trend lower. We think that is a reasonable expectation, but it it shows no sign of turning negative. It would take a very different set of numbers from the ones above for that to be a possibility.

All in all, the market is more vibrant now than almost anyone expected it to be. This is good news for sellers, agents, title companies, lenders and developers. If interest rates start to rise again then we may see another mild slowdown, like we experience from September 2018 to February 2019, but at the moment the market engine is firing on all cylinders once more.