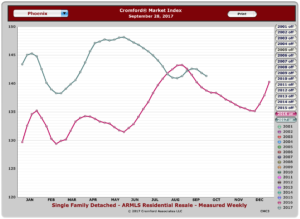

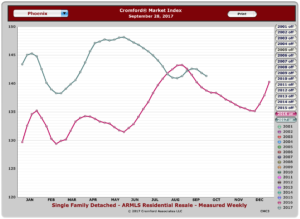

For the 2017 Market Update, we get some help from the Cromford Report. First, here’s their over-all market analysis. Followed below by my more localized analysis of what we are seeing.

“For the monthly period ending September 15, we are currently recording a sales $/SF of $149.06 averaged for all areas and types across the ARMLS database. This is down 11 cents or 0.07% from the $149.17 we now measure for August 15.

On September 15 the pending listings for all areas & types shows an average list $/SF of $153.13, down 0.7% from the reading for August 15.

So we are forecasting another small decline over the next 30 days. (emphasis added) This is slightly unusual since we normally start to see some upward momentum by the beginning of October. Last year at thistime we predicted an increase and the actual result exceed our prediction. We would therefore not be too surprised if today’s forecast turned out to be too pessimistic.”

I added the emphasis for a completely non-scientific and totally gut feeling reason: I can’t shake the feeling that we are over-due for a market correction in 2018. I’m not talking about the 2009 version of earth-shattering, life savings-draining market crash.

I’m thinking more along the lines of a 3-5% downturn, which will, for all intents and purposes, make the 2018 market look more like that late 2015 market.

But, if you are thinking that prices will continue to go up, I’m starting to feel that this will not be the same.

I could see that prices will remain strong in the dense, hip, urban areas that are so popular right now. But they may not be immune to the correction.

What do I base this on?

Here are some admittedly non-scientific bits of analysis. To be fair, few people often predict the market accurately repeatedly, so there is no such thing as a truly scientific method when it comes to market behavior.

Anyway, here is what I’m seeing:

- The Cromford Index, which is a good predictor of what the market will be doing 3-6 months from now, seems to be flat or moving slightly downward over the course of the year, as opposed to 2016. This could mean that the market is moving slowly more toward a buyer’s market and away from a seller’s market. Is it a small change and perhaps premature to discuss? Maybe, but I’d rather be ahead of this than behind.

- The renovation market, which seems to be over 50% of all homes that are active in CenPho and historic neighborhoods, seems to be pushing prices far up above market averages in areas that were pretty rough just a couple years ago. I don’t see entire neighborhoods changing character over night just because a few renovators made an old home look like the interior of a Anthropology outlet at the mall.

- I hear more potential buyers choosing to wait for another year or two because they just can’t believe that prices in some areas will continue to go up. So, yep, its a whiff of a smell in the air, a wil o wisp. But I’ve heard this before. Buyers are tuned in to this frequency, even if subconsciously.

- I’m seeing more and more of what I would consider fly-by-night renovation operations that are churning out some pretty terrible products faster than a Double-Double from In and Out Burger.

Its totally a gut feeling on my part. Take it with a grain of salt. But, as a person who owns an investment property, I’m thinking of selling while the market is relatively high. If you bought in 2010 at the lowest point of the market, then this may not be a concern for you. But if you want to cash out, I would start considering a move.

As we often say, the real estate market is not the stock market. Don’t approach it that way. At the same time, you will never know the lowest or highest point. If you buy generally in the trough and sell generally near the peak, it is a good place to be.

If you need help thinking through your specific situation, give us a call at 602-456-9388.

Its time for Phoestivus 2017, this December 14th and 21st.

Its time for Phoestivus 2017, this December 14th and 21st.