Here is more on deportation from the Phoenix market. In a previous post, I touched on how plans to deport millions of undocumented residents could impact the real estate market in Phoenix.

I told you that we are not likely to see any mass movement any time soon.

But there is one shift that could happen if there is deportation from the Phoenix market, and it has to do with jobs and interest rates, nationally. You’ll want to keep an eye on this.

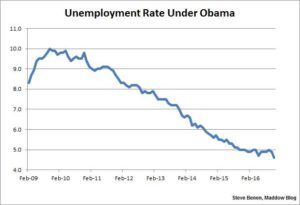

First, know that the unemployment rate just hit the lowest in 9 years on December 2nd, 2016. That is good, over-all. It does not mean that everybody is fully-employed or that they improving wages. But, it is better than it has been.

But it means that the Federal Reserve Bank is watching out to make certain that the economy is not about to overheat. What happens with full employment? When there is full-employment, employees begin to demand higher wages and that puts up-ward pressure on inflation. So, the Fed raises interest rates to slow that growth, reduce wages and inflation.

So, as reported on the Marketplace Morning Report today, if a Trump presidency is able to deport millions of workers just at a time when the economy needs them, unemployment will reduce further, and the Fed will be pushed to increase interest rates even further to slow inflation.

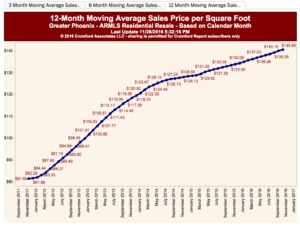

That could affect the housing market, too.

I know, all of this is highly speculative. But my point is that you will want to watch what happens in this sector to see what could happen in the housing market in late 2017.

In good news, Phoenix is expected to be the top market in the country in 2017. I take this with a grain of salt, as you might guess.

“We don’t expect the outcome of the election to have a direct impact on the health of the housing market or economy as we close out 2016. However, the 40 basis points increase in rates in the days following the election has caused us to increase our interest rate prediction for next year,” –Jonathan Smoke, chief economist for Realtor.com in Phoenix Biz Journal, Nov 30, 2016

We will be keeping an eye on the market and the political landscape. If you have questions about how this might affect you, give us a call at 602-456-9388.