Here are some take-aways as we enter the June market, from our friends at the Cromford Report:

1) May continued to be a good time to be a seller in most areas & price ranges.

2) Demand quickly recovered from well below normal in January to slightly above normal by mid April and it has stayed there throughout May.

3) Meanwhile supply continues to drop for an ever-widening collection of areas & price ranges, giving plenty of problems for most buyers who are bumping into each other at the few listings that remain. Multiple offer situations are increasing.

4) If buyers are wanting to spend more than $500,000 then they are in luck – supply is much more plentiful above that mark, though a few very popular areas like Arcadia have relatively slim pickings. During May even those upper price ranges saw a downward trend in active listing counts, but not enough to cause any real problems for most buyers.

5) If today’s normal demand can cause supply to drop as much as it did in the last month, then buyers are going to have an even harder time if demand were to grow.

6) This market is particularly brutal for the entry level market, which is desperately short of homes for sale or rent.

More points:

Active Listings: 20,351 versus 25,555 last year – down 20.4% – and down 5.4% from 21,512 last month.

Pending Listings: 7,819 versus 6,965 last year – up 12.3% – but down 1.7% from 7,951 last month.

Under Contract Listings: 12,063 versus 10,360 last year – up 16.4% – but down 1.7% from 12,276 last month.

Monthly Sales: 8,293 versus 7,509 last year – up 10.4% – but down 2.3% from 8,490 last month.

Monthly Average Sales Price per Sq. Ft.: $136.19 versus $127.65 last year – up 6.7% – and up 0.5% from $135.45 last month.

Monthly Median Sales Price: $211,000 versus $192,500 last year – up 9.6% – and up 4.5% from $202,000 last month

This increase in sales prices over last year is more acute in historic areas from what I’ve seen anecdotally.

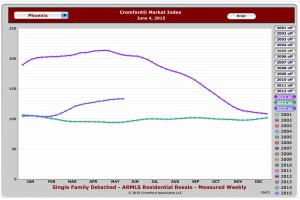

The Cromford Index seems to be flattening out a little bit, as I would expect in the summer. This means the degree to which it is a seller’s market is just not increasing as quickly as it was in April. It is still a solid seller’s market.