There has been a lot of talk recently about how short sales are getting closed with greater success. The data is mixed on that.

On the whole: if you are buying a home on and considering making an offer on a short sale, talk with me first. The speed of your closing depends on who is selling, who is lending and what paperwork they have completed already. It is best to build a strategy around approaching the sale.

Now, on to the data.

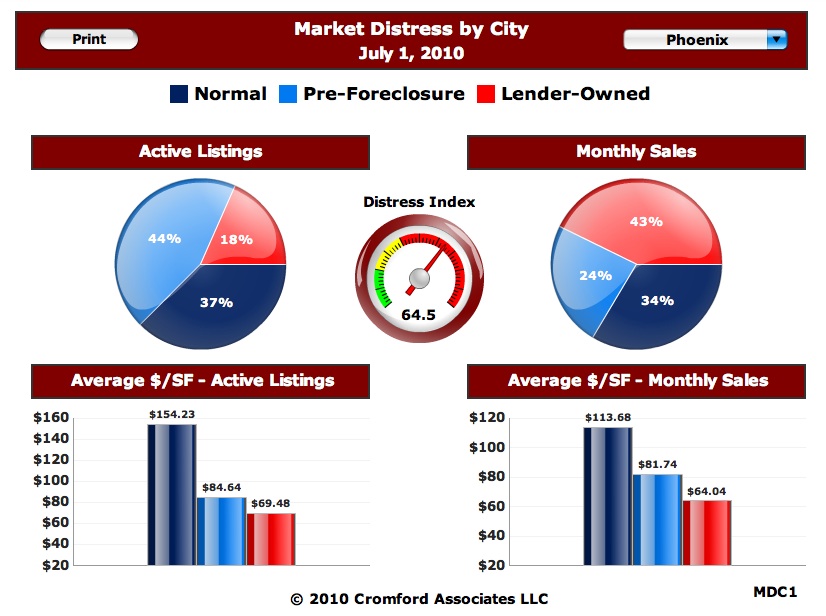

Below is the standard market distress dashboard put out the the Cromford Report. On the left, you see active listing; those that are still on the market. On the left you see that 44% percent of the market that are short sales (“pre-foreclosures”). The average sale price is $84.64 per square foot.

On the right you see what is actually closing and at how much. Only 24% of closings are short sales and they are averaging $81.74 per square foot.

I find it interesting that some folks think short sales are such a great deal, but notice that foreclosed properties are actually cheaper. Yep, they are harder to find, but I’ve noticed something in my clients: while we are waiting for the short sale to close, they many times see a foreclosed property that they would rather have.

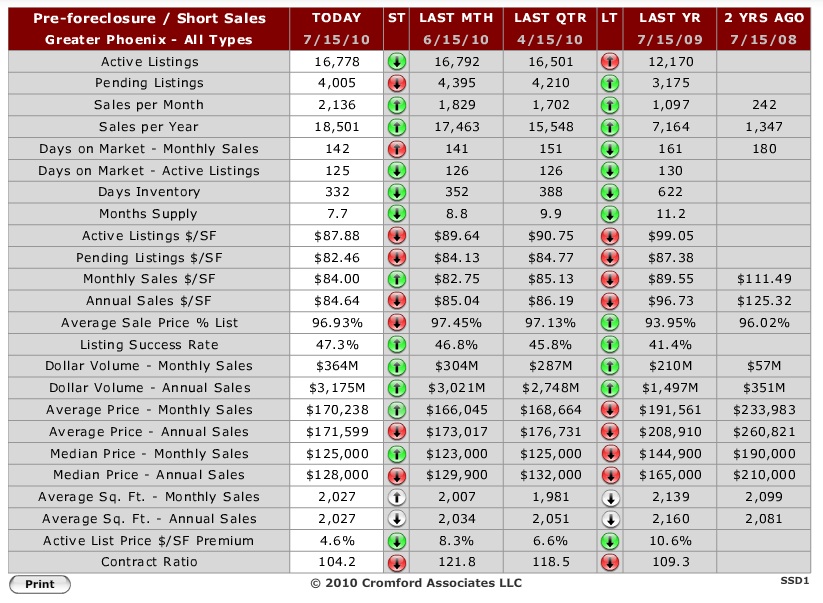

So, bear with me a little more as I geek out on the speed at which short sales are selling, and the price. See the chart below and compare today’s information with the column for last year. The active listings, and sales per month are all up. In the case of sales, they are double. Look further down the chart and see that the sold price per square foot is actually down from last year.

So, what is happening here? Well, the listing agents who are listing the short sales are getting better at negotiating the banks’ processes. The banks are getting better at clearing the short sales and they are more likely to negotiate a lower price. Even the time needed to close (days on market) has come down.

All of this points to one conclusion: short sales are worth the risk if your agent (me, hopefully) can get a good sense of the players in the deal and whether they are likely to close on time. I can help you with this analysis. Call me at 602-456-9388.