It is a bit too early to see if there has been a massive drop in prices, as predicted by some of our more speculative and sloppy reporters.

But we can see a couple other trends that your might find interesting:

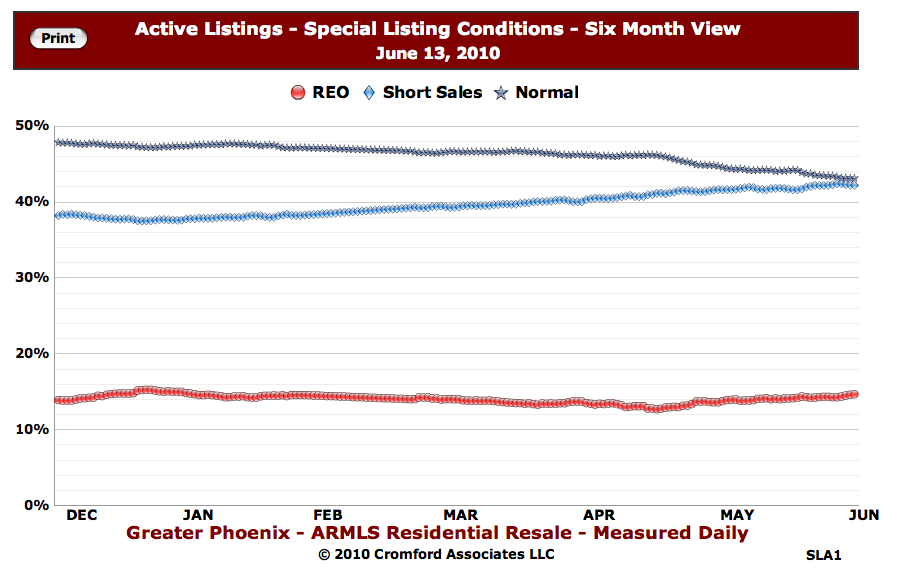

#1 The Number of Foreclosures in the Market is Starting to Drop. According to this article in NuWire, an investment newsletter, “Last month they (foreclosures) represented 50.5 percent of the resale market, compared with 64.9 percent a year earlier. The peak for foreclosure resales was 66.2 percent in March 2009.”

The Arizona Republic, usually happy to predict the end of days every time the wind changes direction said “Foreclosures were 33 percent of the market’s recorded activity in May, down from 40 percent in March, according to the latest realty-studies report.

This does not mean that the market it out of distress. The number of short sales is edging upward as sellers, banks and agents get better at selling homes before they go to foreclosure. See below. What does this mean? It means that if you are looking to buy, you are more likely to want to look for short sales and leave yourself plenty of time for the deal to close –3 to 6 months.

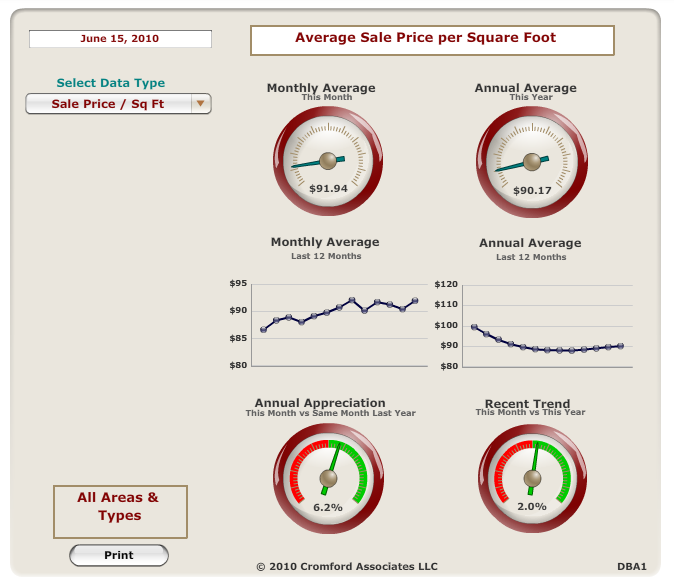

#2 Prices Per Square Foot Are Going Up. So, this means that regardless of the size of the home, people are willing to pay more. Not a whole lot more, but they are edging upward.

So, what does this mean? I think it means that once all of the dust settles from the tax credit, we will be on a steady, slow upward climb back to normal and that it will take a couple years. If you are looking to sell, hang tight unless you are looking at using the low market to trade up. If you are looking to buy, you should be looking now because a 5% increase in the home price can me $100 more per month, depending on the home.

This also means that closing on a home is a little different than it used to be. You are more likely to have to deal with a bank and you may take longer to close. But, that is why you ask me to help you! I protect you from the difficulty of dealing with banks and represent your interests.