Interest rates are on the way up!

We’ve been hearing talk of it for a while, but now its probably going to be a reality — not once, but maybe three times in the next 18 months.

So, what does this do to the price of a home? As you can guess, a lot!

For instance, if you buy a $200,000 house at 4.5% interest with a 5% down payment, your monthly payment (before taxes and insurance) would be $962. The same house at 5% interest would cost $1,019 per month.

That extra $57 per month difference may not seem like much. However, that is $684 per year or $20,520 over the life of the loan!

I don’t know about you, but I can think of a few things that I could do with that money. There are a few countries on my bucket list that I’d like to visit and I don’t want interest rates to keep me from going.

Another way to look at it is that in order to have the same payment every month that you had at 4.5% interest, you could only afford a house that costs $189,000 at 5% interest.

Another way to look at it is that in order to have the same payment every month that you had at 4.5% interest, you could only afford a house that costs $189,000 at 5% interest.

So, what does this mean? It means that you want to consider getting in to the market before interest rates go up.

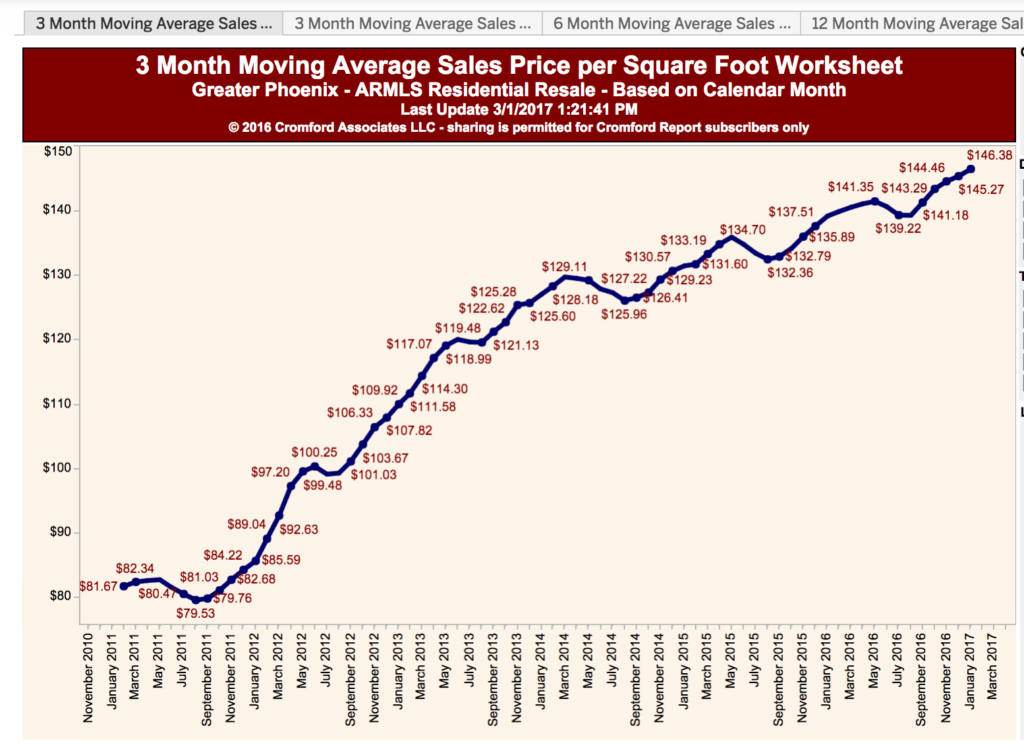

It also means that you probably want to act before both prices and interest rates go up, which they are doing now. That is to be avoided!

Further, we’ve been hearing news stories that the Federal Reserve bank may be thinking of raising interest rates multiple times in the next 18 months or so. If prices in Phoenix continue to go up at the same time these interest rates are going, that could be a problem for you.

What’s the take-away? If you can buy now, you might want to make it happen.

Give me a call. I’m more than happy to help you navigate the market: 602-456-9388.