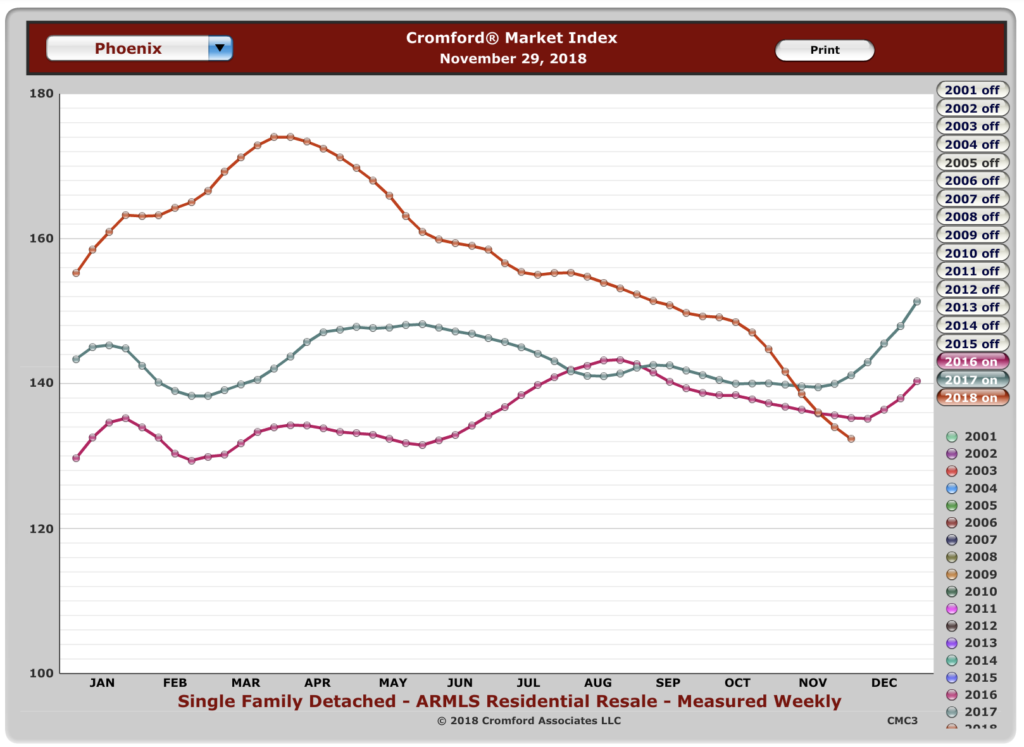

The Cromford Index shows who has the advantage and by how much. Seller advantage has been slipping since May.

We are fairly certain that the seller’s advantage in the market is slipping right now.

See this blog post from last month about the seller’s market and the Cromford Index for more information about.

It does not necessarily mean that houses will drop in price drastically. Frankly, we won’t know how permanent this change is until the end of January. It is very possible that buyers are staying away because they were watching the elections, the dropping stock market and the President’s trade wars.

However, because there is still a shortage of homes in CenPho, I don’t think any price drop will be too drastic –certainly not as much as it could be in the suburbs.

I’ve predicted a drop of between 5% and 7% over 2019, if the market drops at all.

However, if you are waiting to purchase because you’ve been hearing rumors of an over-heated market, you might want to consider this important point: you may lose any savings from a lower market when interest rates go up. See this article that I wrote a couple years ago on the issue.

And to be sure, the Federal Reserve is making strong noises that it will raise interest rates throughout 2019.

In short, if you purchase a $300,000 home today at 4.5% interest and 5% down, your P&I will be about $1,444, depending on the lender. If that home were listed at 5% less next summer ($285,000) but interest rates go up to 5.5% with 5% down, your P&I will be about $1,537!

So, if you are waiting, you could end up paying more. If you get in now and make an aggressive offer while sellers are feeling the slow market you could save money and avoid the higher interest rates.

I happen to know a couple realtors who are really good at negotiating offers, by the way. Call us at 602-456-9388.