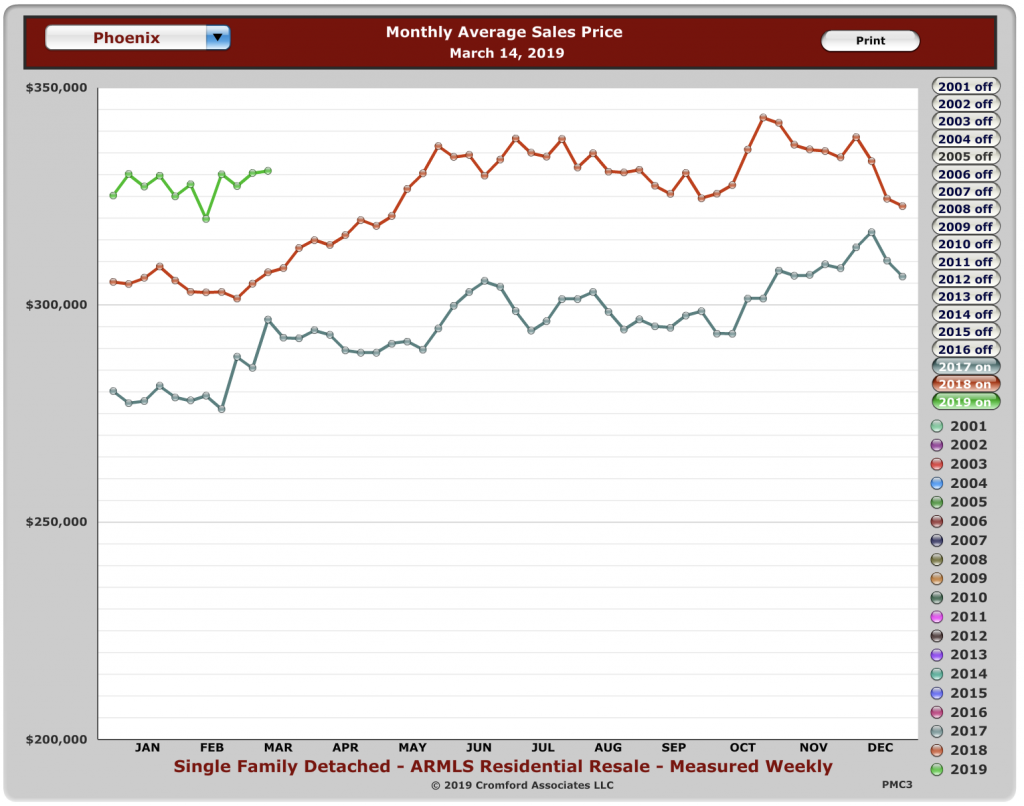

Our friends at the Cromford Report were correct when they predicted the current weakness in prices and their mid-month data may be showing the prices could start going up again.

Watch this space. This story is not over yet.

For now, here is an extended excerpt from the Report.

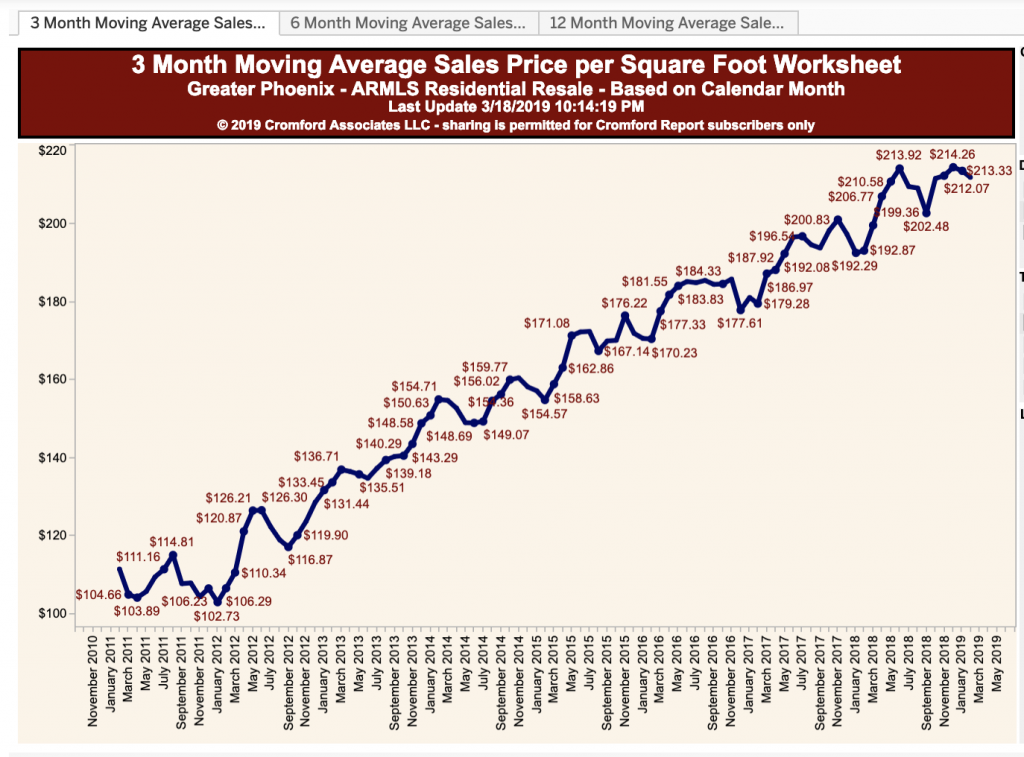

“Each month about this time we look back at the previous month, analyze how pricing has behaved and report on how well our forecasting techniques performed. We also give a forecast for how pricing will move over the next month.

For the monthly period ending March 15, we are currently recording a sales $/SF of $171.77 averaged for all areas and types across the ARMLS database. This is up 2.5% or $4.16 from the $167.61 we now measure for February 15. Our forecast range mid-point was $169.20, with a 90% confidence range of $165.82 to $172.58. The actual result was higher than the mid-point but within the 90% confidence range.

On March 15 the pending listings for all areas & types shows an average list $/SF of $174.59, down 0.6% from the reading for February 15. Among those pending listings we have 97.4% normal, 1.0% in REOs and 1.6% in short sales and pre-foreclosures. This mix is similar to last month and has far fewer distressed properties than the historical average.

Our mid-point forecast for the average monthly sales $/SF on April 15 is $170.73, which is 0.6% below the March 15 reading. We have a 90% confidence that it will fall within ± 2% of this mid point, i.e. in the range $167.32 to $174.14.

The average $/SF was stronger than predicted over the last 2 months, but this was largely due to the mix of homes that closed. High end homes were more strongly represented in January and February. The average $/SF for pending listings has fallen back a little as the mix reverts to normal. The overall price trend continues to move higher, as is normal for the spring season.”